When planning your financial strategy for the year ahead, understanding the difference between a family office and traditional wealth management could be the key to unlocking better results. If you’re a high-net-worth individual or family aiming to protect and grow multigenerational wealth, the question in 2025 isn’t just how to manage your assets—but who should manage them.

This guide explores the core differences between family offices vs. traditional wealth management models, and helps you determine which aligns better with your 2025 goals.

Understanding the Basics

What Is a Family Office?

A family office is a private wealth management firm established specifically to manage the financial, investment, legal, tax, and personal affairs of one ultra-high-net-worth family—or, in the case of a multi-family office, a few select families.

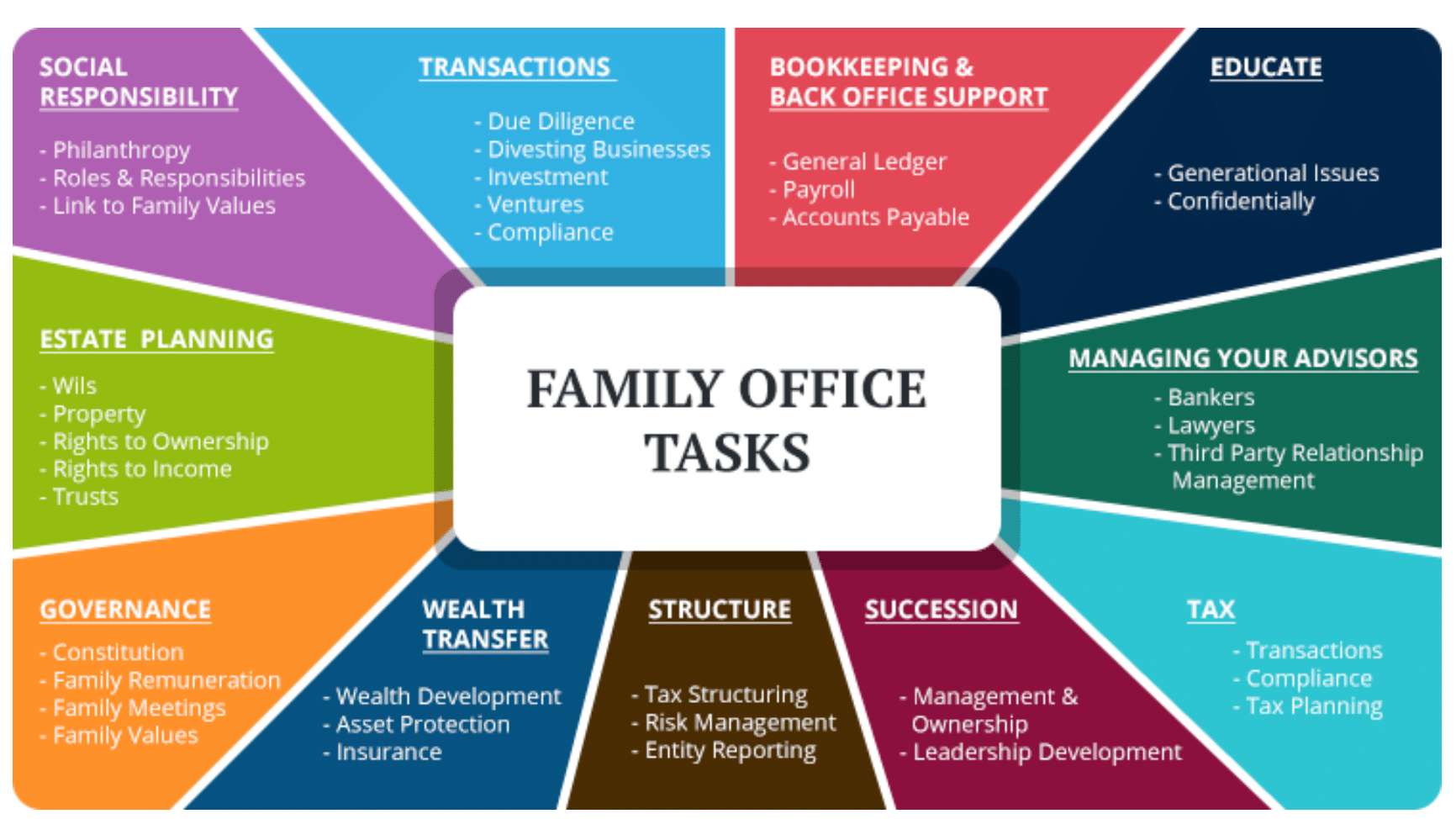

Key characteristics:

- Customized financial and estate planning

- Investment management across asset classes

- Tax and legal advisory

- Philanthropic planning

- Family governance and legacy planning

What Is Traditional Wealth Management?

Traditional wealth management typically involves working with a financial advisor or registered investment advisor (RIA) who manages a client’s investments and provides financial planning. It’s a more standardized solution that may include:

- Investment portfolio design

- Retirement and tax planning

- Risk management and insurance

- Estate planning guidance (often in coordination with outside attorneys)

David Kassir and the team at Manna Wealth Management offer a sophisticated hybrid approach—giving clients access to boutique-level strategy without the full expense of building a dedicated family office.

Family Office vs Wealth Management 2025: Key Differences at a Glance

| Feature | Family Office | Traditional Wealth Management |

| Client Type | Ultra-high-net-worth families | HNW individuals, professionals, retirees |

| Assets Under Management (AUM) | Typically $50M+ | Flexible, often $500K–$25M |

| Scope of Services | Fully integrated & concierge-style | Investment-led with planning add-ons |

| Team Structure | In-house or outsourced specialists | Independent advisor or advisory team |

| Cost Structure | High overhead (can exceed $1M/year) | AUM-based fees (typically 1% or less) |

| Privacy & Control | Full control, bespoke governance | High quality but less personalized |

Which Fits Your 2025 Financial Vision?

✅ Choose a Family Office If You:

- Have $50M+ in investable assets

- Manage complex multi-generational wealth

- Need coordination between legal, tax, and estate experts

- Want personal CFO-level oversight

- Prioritize philanthropic giving, legacy, and family governance

You may benefit from a single-family office, or opt for a multi-family office model like what Manna Wealth Management offers—giving you family office capabilities without managing your own infrastructure.

✅ Choose Traditional Wealth Management If You:

- Have between $500K to $25M in assets

- Need active portfolio management and tax-efficient investing

- Value streamlined advice and ongoing planning support

- Prefer lower cost and high flexibility

- Want access to retirement, estate, and tax coordination through a centralized team

David Kassir offers personalized solutions tailored for both high-net-worth and mass-affluent investors, including bespoke portfolios, retirement strategies, and trust coordination.

What’s Trending in 2025 for HNW Individuals?

1. AI-Driven Reporting & Forecasting

Both family offices and top-tier wealth managers now offer AI-enhanced portfolio modeling and forecasting. But true customization often requires the hands-on integration you’d find in a family office or advanced advisory firm like Manna Wealth Management.

2. Tax Law Shifts Ahead of the 2026 Sunset

The Tax Cuts and Jobs Act is set to expire in 2026. Planning in 2025 means getting ahead on:

- Estate tax exemptions

- Capital gains harvesting

- Roth conversions

- Gifting strategies

Your chosen advisor must be ready to pivot and coordinate legal/tax implications quickly—something both models can handle, but family offices do with more depth.

3. Sustainable & Impact Investing

Whether you’re managing $2M or $200M, values-based investing is shaping portfolios. Traditional firms now integrate ESG metrics, while family offices can go further—using direct private investments, philanthropy, and endowments.

The Manna Wealth Difference: Hybrid Family Office Solutions

Not every investor needs a full-blown family office, but many want family office-level strategy without the steep operational costs.

At Manna Wealth Management, we blend:

- Institutional investment management

- Customized legacy planning

- Trust and estate coordination

- Multigenerational wealth education

Through David Kassir’s deep experience in serving affluent families, we offer white-glove advisory services with a boutique feel—perfect for the discerning investor in 2025.

Final Thoughts

When comparing family office vs. wealth management in 2025, your decision should align with your:

- Net worth

- Complexity of needs

- Desire for control

- Cost sensitivity

- Vision for legacy and family governance

No matter your path, you deserve a financial strategy that’s intentional, tax-aware, and built to scale with your life.

Ready to Reassess Your 2025 Financial Plan?

Whether you’re considering a full family office structure or high-touch wealth management, David Kassir and the team at Manna Wealth Management are here to guide your next move.