A bond is a debt obligation. When an investor buys a bond, they are lending money to the issuer for a defined period. In most cases, the issuer agrees to:

- Pay interest at a stated rate (unless it is a zero-coupon bond)

- Repay the original principal at maturity

Bond terms, payments, and risks vary depending on the issuer and bond structure.

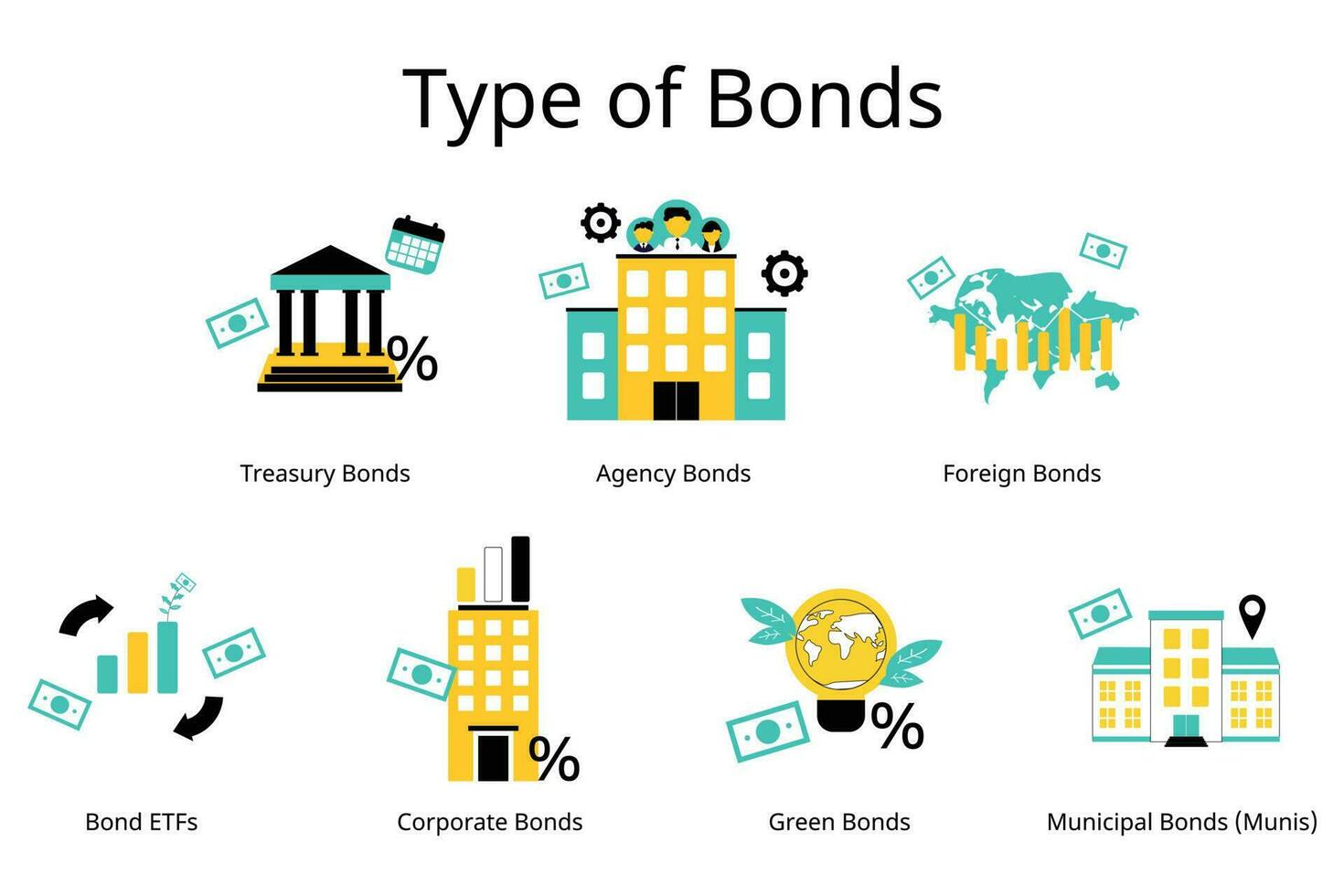

Major Categories of Bonds

Bonds are commonly grouped by who issues them. The three broad categories are:

- U.S. government bonds

- Municipal bonds

- Corporate bonds

Each category serves different purposes and carries different levels of credit, interest rate, and tax risk.

U.S. Government Bonds (Treasury Securities)

U.S. Treasury securities are issued by the federal government to finance its operations. These securities are commonly referred to as Treasuries and are actively traded in secondary markets.

Treasuries are generally considered high credit quality because payments are backed by the U.S. government’s ability to raise revenue. However, this does not eliminate other risks such as interest rate risk or inflation risk.

Types of Treasury Securities

Treasury Bills (T-Bills)

- Short-term securities with maturities of one year or less

- Issued at a discount and do not pay periodic interest

- The investor receives the face value at maturity

Treasury Notes (T-Notes)

- Medium-term securities with maturities from 2 to 10 years

- Pay fixed interest every six months

- Commonly used as market benchmarks

Treasury Bonds (T-Bonds)

- Long-term securities with maturities from 10 to 30 years

- Pay semiannual interest

- More sensitive to interest rate changes due to longer duration

Treasury Inflation-Protected Securities (TIPS)

- Designed to adjust principal based on inflation measures

- Interest payments vary as principal adjusts

- Do not eliminate inflation risk entirely and may fluctuate in value

Tax Considerations for Treasuries

- Interest is subject to federal income tax

- Interest is generally exempt from state and local income taxes

Government Agency and Government-Sponsored Bonds

Some bonds are issued by agencies or organizations created to support public policy objectives, such as housing or agricultural financing.

Examples include bonds associated with:

- Housing finance programs

- Mortgage-related funding initiatives

While some agency bonds carry explicit government backing, others do not. Credit risk varies by issuer and should not be assumed to be identical across all agency bonds.

Municipal Bonds

Municipal bonds, often called munis, are issued by state, county, or local governments to fund public projects such as schools, transportation systems, utilities, and infrastructure improvements.

Common Features of Municipal Bonds

- Interest may be exempt from federal income tax

- Some bonds may also be exempt from state or local taxes

- Tax treatment depends on the investor’s location and bond structure

Types of Municipal Bonds

General Obligation (GO) Bonds

- Backed by the issuing authority’s taxing power

- Not tied to a specific revenue-generating project

- Still subject to fiscal and budgetary risk

Revenue Bonds

- Repaid from income generated by a specific project

- Examples include toll roads or utility systems

- Performance depends on project revenue, not taxing authority

Municipal Bond Risks

- Local governments can experience financial stress

- Tax exemptions are subject to change in tax law

- Some municipal bonds may be subject to alternative minimum tax (AMT)

- Capital gains taxes may apply when bonds are sold at a profit

Corporate Bonds

Corporate bonds are issued by companies to raise capital for business activities such as expansion, refinancing debt, or funding operations.

Corporate bonds generally involve higher credit risk than government bonds, but they often offer higher stated interest rates as compensation for that risk.

Investment-Grade Corporate Bonds

- Issued by companies with stronger credit ratings

- Lower default risk compared to lower-rated issuers

- Still subject to market and business risks

High-Yield (Non-Investment-Grade) Bonds

- Issued by companies with lower credit ratings

- Higher credit risk and price volatility

- More sensitive to economic and company-specific changes

Specialized Corporate Bonds

Convertible Bonds

- Can be converted into company stock under specific conditions

- Combine features of debt and equity

- Carry both credit risk and equity market risk

Zero-Coupon Bonds

Zero-coupon bonds do not make periodic interest payments. Instead, they are issued at a discount to face value and mature at full value.

Key characteristics:

- No regular income during the life of the bond

- Price can fluctuate significantly with interest rate changes

- Tax considerations may apply to imputed interest

- Issued by governments, corporations, and municipalities

Bond Maturity and Duration Differences

Bonds can also be categorized by how long they last:

- Short-term: typically under 3 years

- Intermediate-term: approximately 3–10 years

- Long-term: over 10 years

Longer maturities generally involve greater sensitivity to interest rate changes, but no maturity length eliminates risk.

Key Risks That Apply to All Bond Types

Regardless of issuer, bonds share common risks that investors should understand:

Interest Rate Risk

When interest rates rise, bond prices typically fall.

Credit Risk

Issuers may experience financial difficulty, affecting their ability to make payments.

Inflation Risk

Inflation can reduce the purchasing power of interest payments.

Liquidity Risk

Some bonds may be harder to sell at a desired price.

Market Risk

Bond values fluctuate based on economic conditions and investor demand.

Educational Disclosure

- Bonds are not risk-free investments

- Principal value and returns are not guaranteed

- Past bond performance does not predict future results

- Tax treatment depends on individual circumstances and may change

- Bond funds carry additional market and management risks

This article is intended to provide general educational information, not personalized investment advice.

Final Thoughts

Bonds come in many forms, each with distinct characteristics, risks, and potential trade-offs. Understanding the differences between government, municipal, corporate, and specialized bonds can help investors better evaluate how bonds function within a broader financial context.

Careful analysis, realistic expectations, and awareness of risk are essential when learning about or evaluating any type of bond.