When it comes to managing money, budgeting is often the first place people get stuck. Not because they don’t care—but because many budgeting systems feel unrealistic, restrictive, or disconnected from real life.

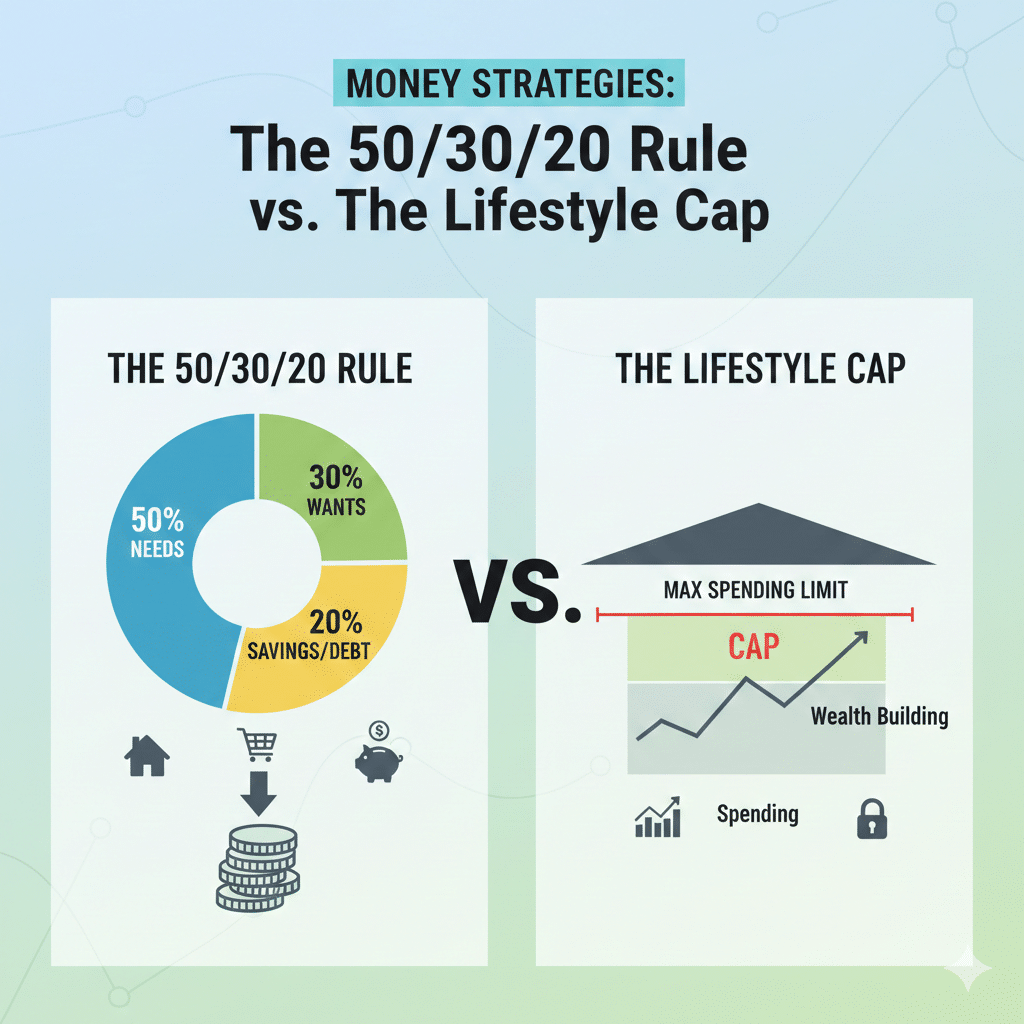

Two popular approaches people often compare are the 50/30/20 Rule and the Lifestyle Cap. Both aim to help you control spending and build financial stability, but they work very differently. One relies on fixed percentages, while the other focuses on intentional limits tied to lifestyle choices.

This article breaks down how each strategy works, where each can be helpful, and how to decide which approach may better fit your situation—without implying guaranteed outcomes or universal solutions.

Why Budgeting Strategies Matter

A budgeting strategy is not about perfection. It is about awareness, consistency, and alignment between your money and your priorities.

The right approach should help you:

- Cover essential expenses

- Enjoy life responsibly

- Save and invest steadily

- Adjust as income or expenses change

No single method works for everyone. Understanding how different strategies operate allows you to choose one that fits your income level, lifestyle, and financial goals.

Understanding the 50/30/20 Rule

The 50/30/20 Rule is a percentage-based budgeting framework that divides after-tax income into three broad categories:

- 50% Needs – Housing, utilities, groceries, insurance, transportation

- 30% Wants – Dining out, entertainment, travel, hobbies

- 20% Savings – Emergency fund, retirement savings, debt repayment

Why People Use the 50/30/20 Rule

This approach is popular because it is:

- Simple to understand

- Easy to track

- Structured without being overly detailed

For individuals with steady income and moderate living costs, the rule can serve as a starting framework to build financial awareness.

Limitations of the 50/30/20 Rule

While useful, the 50/30/20 Rule has limitations that are important to recognize.

Cost-of-Living Challenges

In higher-cost areas, especially parts of California, housing alone can exceed 50% of income. This can make the rule feel unrealistic or discouraging.

Income Variability

For those with variable income—such as business owners, commission-based professionals, or freelancers—fixed percentages may not align well with fluctuating cash flow.

Oversimplification

Not all “needs” or “wants” are equal. A rigid percentage split may ignore personal priorities or life stages.

Because of these factors, the rule works best as a guideline, not a requirement.

What Is the Lifestyle Cap?

The Lifestyle Cap takes a different approach. Instead of dividing income into percentages, it sets an intentional limit on lifestyle spending—even as income grows.

The core idea is simple:

As income increases, lifestyle expenses are allowed to rise only to a certain point. The rest is directed toward savings, investing, or long-term goals.

How the Lifestyle Cap Works in Practice

Under a Lifestyle Cap approach:

- Essential and lifestyle expenses are defined clearly

- A spending ceiling is established for lifestyle costs

- Income increases do not automatically lead to higher spending

- Surplus cash is intentionally redirected

This strategy emphasizes control and intentionality rather than formulas.

Why Some People Prefer the Lifestyle Cap

The Lifestyle Cap can be especially appealing to:

- High-income earners

- Professionals with rising salaries

- Individuals focused on long-term financial independence

- Those who want flexibility without losing discipline

Rather than asking, “What percentage should I spend?” the question becomes:

“How much lifestyle spending is enough for me to live well?”

Potential Challenges of the Lifestyle Cap

Like any strategy, the Lifestyle Cap is not without challenges.

Requires Self-Awareness

This approach depends heavily on honest self-assessment. Without clarity, spending limits can slowly expand.

Less Structure

Some people prefer clear numerical rules. The Lifestyle Cap requires more judgment and regular review.

Discipline Is Essential

Because the system is flexible, it relies on consistent decision-making rather than fixed guardrails.

Comparing the Two Approaches

| Factor | 50/30/20 Rule | Lifestyle Cap |

| Structure | Fixed percentages | Flexible spending limits |

| Best For | Stable income, moderate costs | Higher income or growing earnings |

| Ease of Use | Very simple | Requires more thought |

| Flexibility | Limited | High |

| Focus | Balance across categories | Intentional lifestyle control |

Neither approach is superior in all cases. Each serves different needs.

Choosing the Strategy That Fits You

When deciding between these approaches, consider the following questions:

- Is my income stable or variable?

- Do fixed percentages feel realistic in my location?

- Am I more motivated by structure or flexibility?

- Do I want a simple starting point or a customizable system?

Your answers may change over time—and so may your strategy.

A Hybrid Approach: Combining Both Methods

Some people find value in using both strategies together.

For example:

- Use the 50/30/20 Rule as a baseline for awareness

- Apply a Lifestyle Cap to control spending as income grows

- Adjust percentages or caps during major life changes

This blended approach allows structure without rigidity.

Long-Term Perspective Matters More Than the Method

No budgeting strategy guarantees success. What matters more is:

- Consistency over time

- Regular review and adjustment

- Alignment with real-world behavior

- Willingness to adapt

A strategy that works well today may need refinement tomorrow.

Final Thoughts

The 50/30/20 Rule and the Lifestyle Cap are both tools—not solutions by themselves. Each can help improve financial clarity when applied thoughtfully and realistically.

The right strategy is the one you can follow consistently, adjust responsibly, and use to support your long-term financial goals without unnecessary stress.

Rather than asking which method is better, a more useful question is:

“Which approach helps me make clearer, more intentional decisions with my money?”

That answer may evolve as your life does—and that is exactly how financial planning should work.