Fiduciary Financial Advisor in Orlando, Florida

Choosing a financial professional is one of the most important long-term decisions an individual or family can make. Whether planning for retirement, managing accumulated wealth, navigating business liquidity events, or preparing for generational wealth transfer, the...

Wealth Management for Entrepreneurs in Miami

As a financial advisor working with business owners and founders, I understand that entrepreneurs in Miami face a very different financial landscape than salaried professionals. Income volatility, liquidity events, reinvestment decisions, tax complexity, and asset...

Financial Planning for Doctors in Miami

As a financial advisor working closely with medical professionals, I understand that physicians in Miami face a unique combination of opportunity and complexity. High earning potential, significant student loan burdens, evolving tax regulations, and practice ownership...

Retirement Planning for Federal Employees in Miami

As a financial advisor working with professionals across South Florida, I often speak with federal employees who want clarity around their retirement options. Federal benefits can be powerful—but they are also complex. Coordinating pensions, Thrift Savings Plan (TSP)...

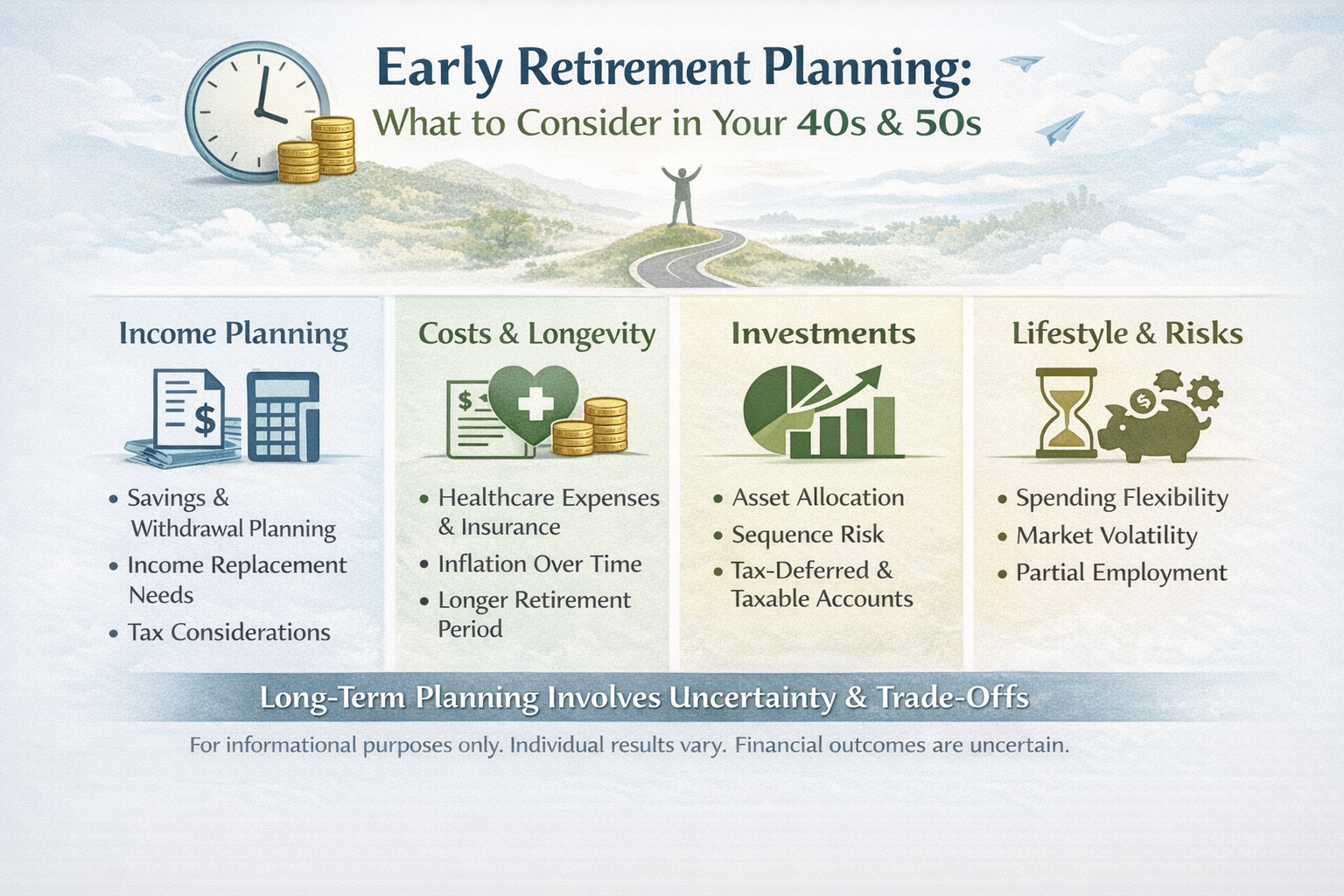

Early Retirement Planning: What to Consider in Your 40s and 50s

Introduction “Early retirement” is generally used to describe leaving full-time work before the traditional retirement age, often before one becomes eligible for standard government retirement benefits. For many individuals, serious planning discussions around this...

Family Office vs. Traditional Wealth Management: Understanding Structural Differences

Different wealth management structures are designed to address varying levels of financial complexity and personal circumstances. Among the most commonly discussed models are family offices and traditional wealth management firms. While both are involved in helping...

Cryptocurrency Tax Planning for Florida Investors in 2026

Cryptocurrency taxation continues to evolve as digital assets become more widely used for investment, transactions, and payments. While virtual currencies operate on decentralized networks, tax reporting obligations are generally determined by existing federal tax...

How to Choose the Right Financial Advisor in California

Choosing a financial advisor is one of the most meaningful financial decisions you will ever make. This is not just about picking investments or chasing returns—it is about choosing a professional who understands your life, your goals, your concerns, and the realities...

The 50/30/20 Rule vs. the Lifestyle Cap: Which Strategy Fits You?

When it comes to managing money, budgeting is often the first place people get stuck. Not because they don’t care—but because many budgeting systems feel unrealistic, restrictive, or disconnected from real life. Two popular approaches people often compare are the...

What Is a Bond, in Simple Terms?

A bond is a debt obligation. When an investor buys a bond, they are lending money to the issuer for a defined period. In most cases, the issuer agrees to: Pay interest at a stated rate (unless it is a zero-coupon bond) Repay the original principal at maturity Bond...

What Is a Dividend?

A dividend is a payment that a company may choose to distribute to its shareholders, usually from its profits or retained earnings. Key points to understand: Dividends are not required by law Companies decide if, when, and how much to pay Dividends can be reduced,...

What Is an IRA Rollover?

An IRA rollover is a process that allows an individual to move retirement assets from one qualified retirement account into an Individual Retirement Account (IRA), or from one IRA to another, under specific rules. Rollovers are commonly considered when someone changes...

Start the Conversation