Introduction

“Early retirement” is generally used to describe leaving full-time work before the traditional retirement age, often before one becomes eligible for standard government retirement benefits. For many individuals, serious planning discussions around this concept tend to begin in their 40s and 50s, when career earnings may be higher but the remaining working years are fewer.

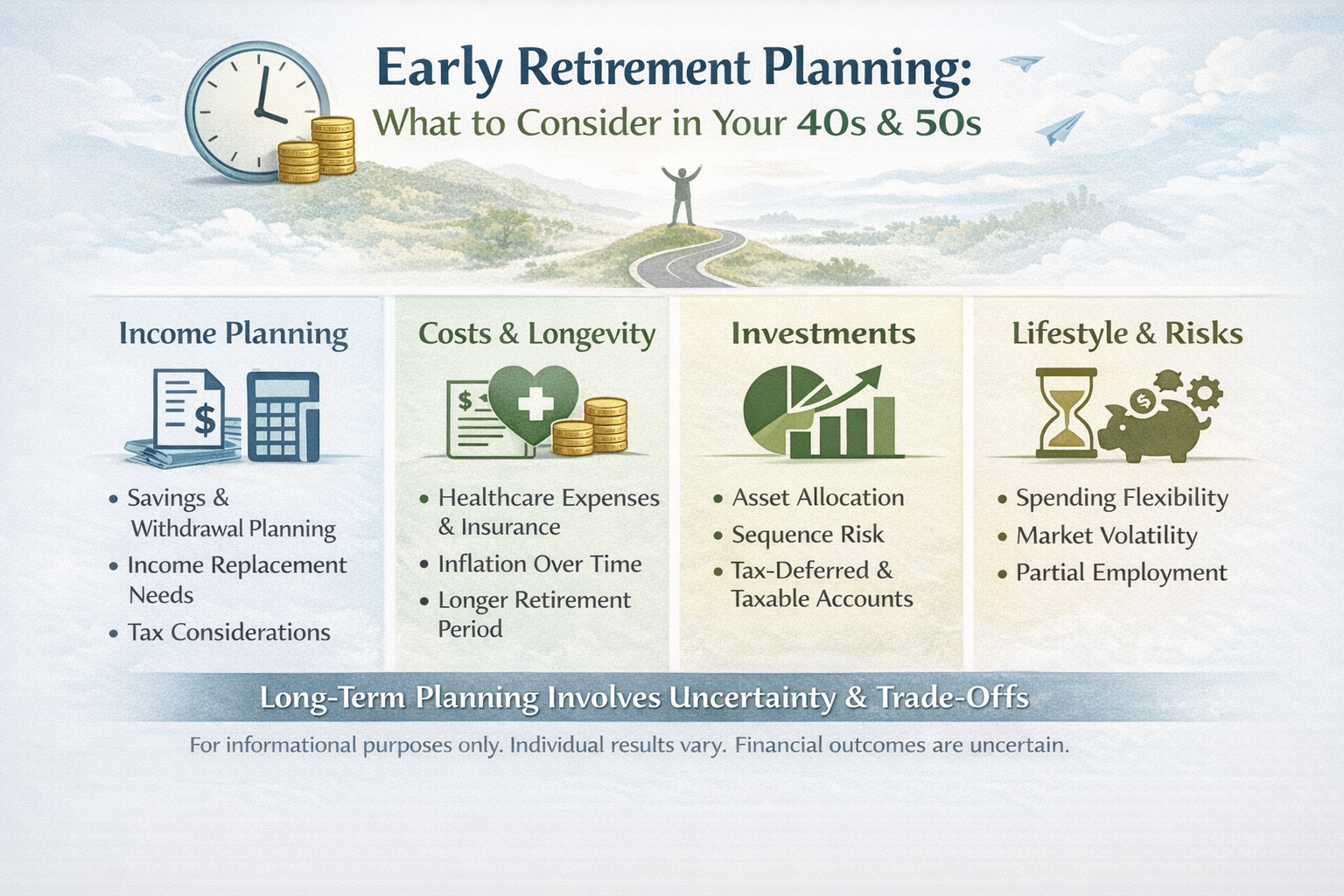

Planning for an earlier retirement timeline often involves meaningful trade-offs and uncertainties. Market conditions, health considerations, lifestyle choices, and personal priorities all play a role. This article discusses general planning concepts for educational purposes and does not assume that early retirement is appropriate or achievable for every individual.

Why Planning Often Begins in the 40s and 50s

Individuals in their 40s and 50s are frequently at a stage where financial patterns are more established. This period may involve:

- Higher peak earning years

- Greater clarity about long-term lifestyle preferences

- A shorter time horizon to adjust savings and spending behavior

At the same time, planning during this stage may involve balancing competing priorities such as education expenses, mortgage obligations, caregiving responsibilities, or career transitions.

Common Planning Considerations

Early retirement planning often involves reviewing multiple interconnected factors rather than focusing on a single goal.

Income Replacement Planning

Leaving the workforce earlier generally means a longer period without employment income. Planning may require estimating how income needs could be met through a combination of personal savings, investments, and other resources. This process often involves assumptions that may change over time.

Healthcare Cost Considerations

Healthcare expenses are a significant uncertainty for individuals considering retirement before traditional eligibility ages. Planning often involves estimating potential insurance costs, out-of-pocket expenses, and the impact of unexpected medical events.

Longevity and Inflation Risks

Planning for a longer retirement period increases exposure to:

- Longevity risk, or the possibility of outliving available resources

- Inflation risk, which may reduce purchasing power over time

These factors are difficult to predict and may require periodic reassessment.

Liquidity and Cash-Flow Planning

Maintaining access to liquid assets can be important when income sources change. Planning may include evaluating how expenses will be met during market downturns or periods of higher-than-expected spending.

Savings and Investment Considerations

Early retirement planning often involves reviewing how savings and investments are structured, while recognizing that outcomes are uncertain.

Tax-Advantaged Accounts

Individuals may consider how different types of accounts are taxed and accessed. Rules surrounding withdrawals, penalties, and timing can affect cash-flow flexibility and long-term planning.

Asset Allocation Concepts

Asset allocation refers to how investments are distributed among different types of assets. Allocation decisions often involve balancing growth potential with volatility and liquidity needs, especially when the investment time horizon shortens.

Sequence-of-Returns Risk

Sequence-of-returns risk refers to the impact that the timing of market gains and losses can have on long-term outcomes, particularly when withdrawals begin early. Market downturns early in retirement may have a disproportionate effect on available resources, even if long-term average returns appear similar.

Lifestyle and Risk Trade-Offs

Early retirement planning often involves trade-offs that extend beyond financial calculations.

Spending Flexibility

Some individuals plan for flexibility in discretionary spending, allowing adjustments during periods of market volatility or unexpected expenses.

Market Volatility Impact

Market fluctuations can have a greater impact when assets are being drawn down rather than accumulated. Planning often includes considering how volatility may affect short-term and long-term decisions.

Employment Income Changes

Some individuals explore partial employment, consulting, or flexible work arrangements. Income changes can affect both cash flow and long-term planning assumptions.

Planning Issues to Be Aware Of

While every situation is different, certain issues commonly arise in early retirement discussions.

Underestimating Healthcare Costs

Medical expenses and insurance costs may be higher or more variable than expected, particularly over a long retirement period.

Ignoring Inflation Over Long Periods

Even modest inflation can significantly affect purchasing power over several decades, especially for fixed or semi-fixed income streams.

Overly Optimistic Assumptions

Assumptions about investment performance, spending needs, or future expenses may not align with actual outcomes. Reviewing and updating assumptions regularly is often part of prudent planning.

Closing Perspective

Early retirement planning involves navigating uncertainty, making assumptions, and revisiting decisions over time. There is no universal approach that applies to everyone, and outcomes can vary widely based on personal circumstances, economic conditions, and life events.

Understanding general planning concepts may help individuals think more clearly about their priorities and prepare for informed discussions with qualified financial, tax, and legal professionals. Reviewing plans periodically and adjusting assumptions as circumstances change is often an important part of long-term financial planning.

Important Notes

- This material is for informational purposes only.

- This is not investment, tax, or legal advice.

- Individual circumstances vary, and financial outcomes are uncertain.