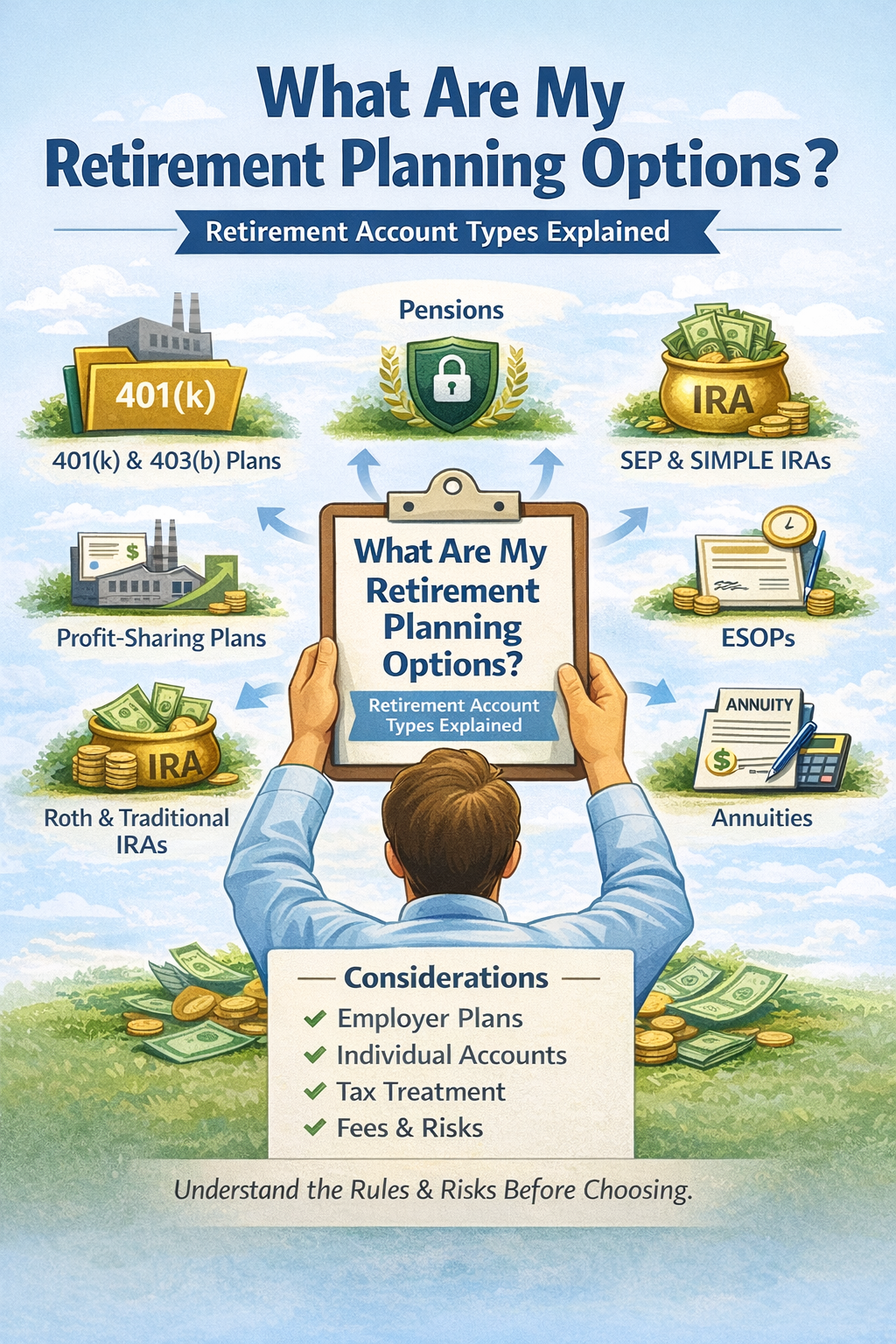

What Are My Retirement Planning Options?

Retirement planning involves selecting from a range of account types and benefit arrangements that help individuals set aside money for later life. Some options are sponsored and funded by employers, while others rely entirely on individual contributions. Each option has its own rules, tax treatment, withdrawal conditions, and limitations.

Important General Rules to Know

Before reviewing specific retirement options, it is helpful to understand a few general guidelines that apply to many plans:

- Withdrawals made before age 59½ may be subject to a 10% federal tax penalty, unless an exception applies

- Most retirement distributions are taxed as ordinary income

- Required Minimum Distributions (RMDs) generally must begin by April 1 of the year after reaching age 73 (or age 75 for individuals who reach age 73 after December 31, 2032)

- Tax laws and age thresholds are subject to change

These rules vary by plan type and personal circumstances.

Employer-Sponsored Retirement Plans

Many retirement options are provided through the workplace. These plans are often funded partially or entirely by employers.

Defined Benefit Pension Plans

A defined benefit pension typically provides a fixed monthly payment beginning at retirement and continuing for life, based on a formula that often includes salary history and years of service. These plans are generally funded by the employer and place investment responsibility on the plan sponsor rather than the employee.

Money Purchase Pension Plans

Money purchase plans are employer-funded retirement plans that promise contributions rather than a specific benefit amount. The retirement benefit depends on contribution levels and investment performance. Benefits may be paid as a lump sum or as periodic payments.

Profit-Sharing Plans

Profit-sharing plans allow employers to contribute discretionary amounts to employees’ retirement accounts. Contributions may vary from year to year and are often influenced by business performance. In some arrangements, employees may also contribute, particularly when the plan is structured as a 401(k).

Employer Savings and 401(k) Plans

Savings plans, including 401(k) arrangements, allow employees to contribute a portion of their wages, often on a pre-tax basis. Employers may also contribute or match employee contributions. These plans typically provide a lump-sum balance at retirement and may permit limited loans or hardship withdrawals under specific conditions.

Employee Stock Ownership Plans (ESOPs)

An ESOP is a retirement plan in which employers contribute company stock on behalf of employees. At retirement, distributions may be made in the form of company shares. Certain diversification options are required once participants reach specific age and service thresholds.

403(b) Plans (Tax-Sheltered Annuities)

403(b) plans are available to employees of eligible nonprofit organizations and educational institutions. These plans are primarily funded by employee contributions, often on a tax-deferred basis. At retirement, participants may choose lump-sum distributions or periodic payments.

Individually Funded Retirement Options

Some retirement accounts are established and funded entirely by individuals, independent of an employer.

Individual Retirement Accounts (IRAs)

IRAs are available to many wage earners, subject to income and contribution limits. They are typically held at financial institutions such as banks, brokerage firms, or mutual fund companies.

- Traditional IRAs may allow tax-deductible contributions, with withdrawals taxed as ordinary income

- Roth IRAs are funded with after-tax dollars, and qualified withdrawals are generally tax-free

Both types may allow lump-sum or periodic withdrawals during retirement.

Retirement Plans for Self-Employed Individuals

Self-employed individuals can establish retirement plans similar to those used by businesses. These plans are funded by the individual and often allow higher contribution limits than standard IRAs.

Common examples include:

- SEP IRAs

- SIMPLE plans

- Solo or self-employed 401(k) plans

These plans follow similar tax and withdrawal rules as other qualified retirement arrangements.

Simplified Employee Pension (SEP) Plans

SEPs are designed for small businesses and self-employed individuals. Employers typically make contributions on behalf of employees, though some arrangements permit employee contributions. SEP assets are usually held in IRA-type accounts and follow IRA distribution rules.

SIMPLE Plans

Savings Incentive Match Plans for Employees (SIMPLE plans) are intended for small employers. Employees contribute on a pre-tax basis, and employers are required to make contributions. SIMPLE plans can be structured as IRAs or as 401(k)-type arrangements.

Annuities as a Supplemental Option

Annuity contracts are not qualified retirement plans, but they are often used alongside retirement accounts to provide tax-deferred growth.

Key considerations include:

- No IRS contribution limits

- Tax-deferred accumulation

- Withdrawals taxed as ordinary income

- Potential early withdrawal penalties

Annuities may involve fees, surrender charges, and contractual limitations. Guarantees, if any, depend on the issuing insurer’s financial strength and claims-paying ability.

Risks, Fees, and Limitations to Understand

Across all retirement options, individuals should be aware of:

- Market risk and investment volatility

- Fees and administrative expenses

- Withdrawal restrictions and penalties

- Tax treatment of distributions

- Changes in laws and regulations

No retirement plan eliminates financial risk or guarantees future income.

Final Thoughts

There is no single retirement planning option that fits every situation. Employer-sponsored plans, individual accounts, and supplemental tools each serve different roles and involve different trade-offs. Understanding how these options work — including their tax treatment, risks, and limitations — can help individuals make more informed decisions as part of a broader retirement planning process.