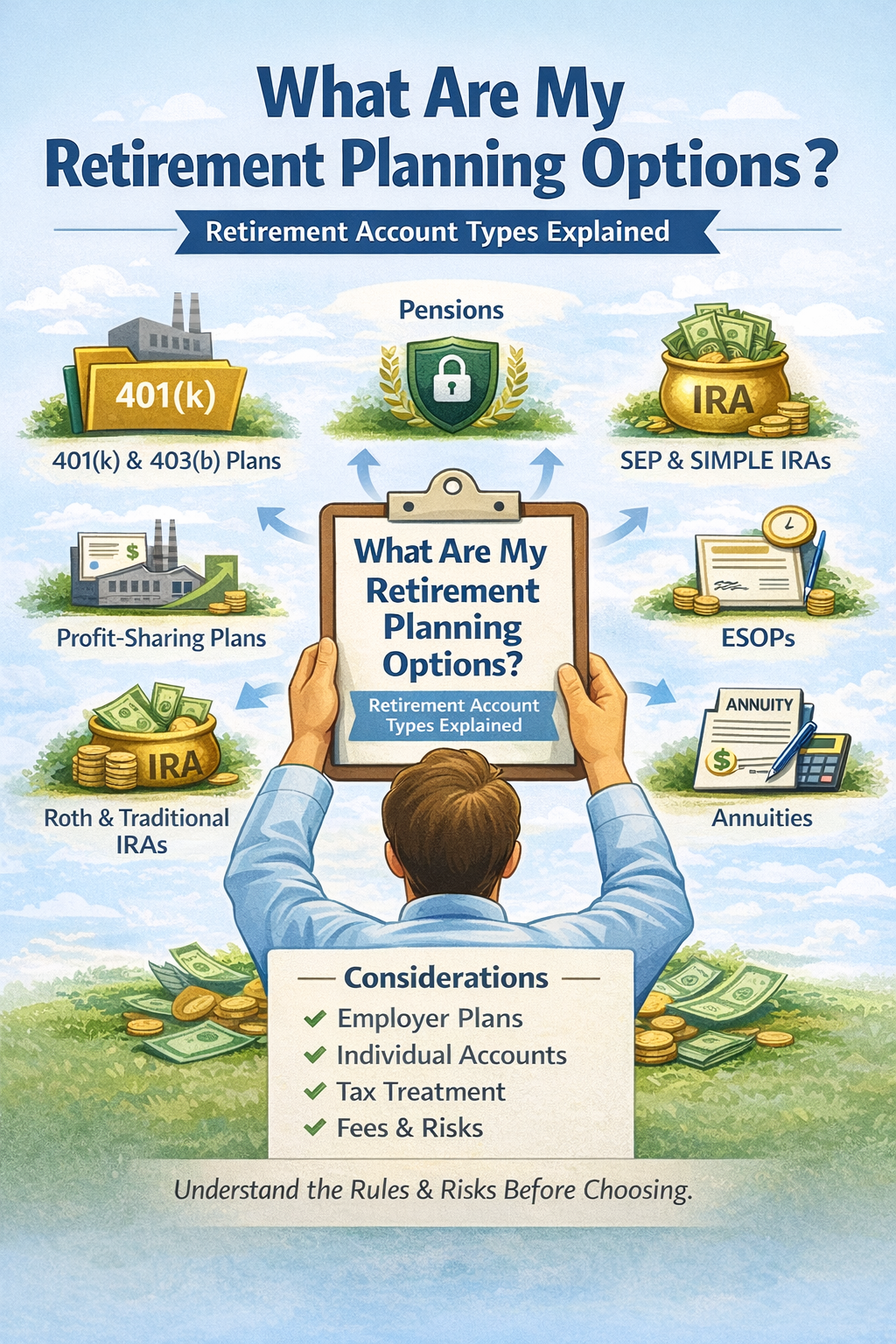

What Are My Retirement Planning Options?

What Are My Retirement Planning Options? Retirement planning involves selecting from a range of account types and benefit arrangements that help individuals set aside money for later life. Some options are sponsored and funded by employers, while others rely entirely...

Why Malibu Retirement Needs Thoughtful Planning

If you dream of living out your retirement years along the Pacific — with ocean breezes, warm sunsets, seaside strolls — then Malibu, California, might be calling your name. But life there, especially for retirees, carries a cost that’s meaningfully higher than many...

Why Tax-Smart Investing Matters Especially in Malibu

When you live or invest in a high-income, high-cost area like Malibu, California, every dollar you keep after taxes makes a real difference. Tax-smart investing is not about predicting markets or promising results. It is simply about making informed choices so your...

Why an Emergency Fund Matters — Especially in a Place Like Malibu CA

Malibu isn’t a typical small town. It’s coastal, picturesque, and yes — expensive. The cost of housing, groceries, healthcare, everyday services — all tend to run higher than in many other parts of the country. That already makes everyday living more demanding. But...

Estate Planning 101 for Malibu Retirees

Estate planning is one of the most powerful tools Malibu retirees can use to protect their financial legacy, support their loved ones, and ensure their wishes are respected. In a place like Malibu—where real estate values can rise or fall by millions depending on the...

How to Build a Malibu-Level Retirement Budget Without Stress

There’s something special about the word Malibu. It evokes sunshine, open vistas, ocean breezes, and a lifestyle that feels both calm and elevated. When clients come to me asking how to achieve a “Malibu-level” retirement, they’re not necessarily asking for beachfront...

Avoid These Common Retirement Planning Mistakes Malibu Residents Make

Planning for retirement in Malibu comes with its own unique rhythm. Yes, the ocean views, relaxed mornings, and salt-air breezes set the stage for a picturesque chapter of life — but behind that serenity is a reality: Malibu is an expensive place to maintain the...

Choosing the Right Financial Advisor in Malibu: What Retirees Should Look For

Retiring in Malibu isn’t just about stepping into a new phase of life — it’s about protecting a lifestyle you’ve worked decades to build. Whether you’re overlooking the Pacific from Point Dume, living in a quiet canyon home in Serra Retreat, or enjoying ocean breezes...

How Can a Malibu Financial Advisor Help Protect Your Coastal Property Wealth?

Living in Malibu comes with sunshine, ocean views, and a lifestyle many people dream about. But behind the sunsets and ocean breeze are real financial responsibilities. High-value coastal homes aren’t just expensive to buy — they’re expensive to own, insure, maintain,...

What retirement options work best for people living in Malibu?

Retirement planning in Malibu looks a little different than it does in most places. The cost of living is higher, real estate is more valuable, and lifestyle expectations tend to be elevated. That means you need strategies that can protect your coastal property,...

How Malibu Retirees Can Protect Their Savings From Inflation

Retirement in Malibu sounds perfect, doesn’t it? Waking up to the sound of the ocean, grabbing coffee on the patio, taking a walk along the beach — it’s a lifestyle many people dream about. But there’s something a lot of retirees here quietly worry about: everything...

Why High-Net-Worth Individuals in Malibu Need Personalized Wealth Management

Malibu is known for its beauty and lifestyle. The ocean, the hills, the homes—it’s a place that attracts wealth. But with wealth comes complexity. High-net-worth individuals here face financial challenges that are not simple. I’ve worked with many families and...

Start the Conversation