If you’re investing—whether in stocks, real estate, or even cryptocurrency—there’s one four-letter word you need to keep in mind: tax. Specifically, capital gains tax.

As a financial advisor working with clients across Florida—from retirees in Naples to young professionals in Miami—I’ve seen how capital gains can be both a blessing and a tax-time surprise. Many investors are unaware that making money from investments often means giving a piece of that gain back to the IRS—unless you plan wisely.

Let’s break it all down so you know exactly what to expect, what you can do to reduce your tax burden, and how to keep more of what you earn.

What Is Capital Gains Tax?

Put simply, capital gains tax is the tax you pay on the profit you make when you sell an investment for more than you paid for it.

Here’s a quick example:

If you bought Apple stock at $100 a share and sold it later for $180, you’ve made an $80 profit per share. That $80 is your capital gain—and it’s taxable.

This applies to:

- Stocks and bonds

- Real estate (excluding your primary home, with some exceptions)

- Mutual funds and ETFs

- Cryptocurrencies

- Collectibles and even art

If you’re an investor in Florida and you’re not factoring capital gains tax into your financial strategy, you’re missing an opportunity to grow wealth more efficiently.

Short-Term vs. Long-Term Capital Gains

The IRS doesn’t treat all gains the same. The length of time you hold an investment plays a big role in how much you’ll pay in taxes.

Short-Term Capital Gains

- Assets held less than a year

- Taxed at your ordinary income tax rate

- This could be anywhere from 10% to 37%, depending on your income

Long-Term Capital Gains

- Assets held more than a year

- Taxed at preferential rates: 0%, 15%, or 20%

- Most middle- and upper-income investors in Florida fall into the 15% category

Holding investments for just a few months longer can sometimes cut your tax bill in half. That’s a strategy we often review with clients at Manna Wealth Management.

Special Rules for Real Estate Investors in Florida

Many Florida residents invest in real estate—vacation homes, rental properties, even Airbnbs. Here’s what you should know:

- If you sell your primary residence, you may exclude up to $250,000 of capital gains ($500,000 if married filing jointly), as long as you’ve lived there for two of the past five years.

- For rental or investment property, capital gains are fully taxable unless you do something smart—like a 1031 Exchange.

A 1031 Exchange allows you to defer capital gains taxes by rolling the proceeds from one investment property into another. But the rules are strict, and timing is everything—so speak to a professional.

How to Reduce or Avoid Capital Gains Tax

There’s good news: You don’t have to accept your tax bill as a given. Here are several strategies I often recommend to my Florida clients:

1. Hold Investments Longer

Switching from short-term to long-term gains can significantly lower your tax rate.

2. Tax-Loss Harvesting

Sell losing investments to offset gains. For example, if you made $10,000 in gains but lost $5,000 on another stock, you’ll only pay tax on the net $5,000 gain.

3. Invest Through Retirement Accounts

Capital gains inside IRAs or 401(k)s aren’t taxed until you withdraw the funds—and in a Roth IRA, gains may never be taxed at all.

4. Stay Below the Threshold

For married couples filing jointly with income under $94,050 in 2025 (or $47,025 for singles), long-term capital gains are taxed at 0%.

5. Use Gifting Strategies

You can gift appreciated assets to family members in lower tax brackets or to a charity—both of which can provide significant tax relief.

If you’re looking for a personalized capital gains tax strategy, our Florida financial advisors can help you build a plan that works for your specific situation.

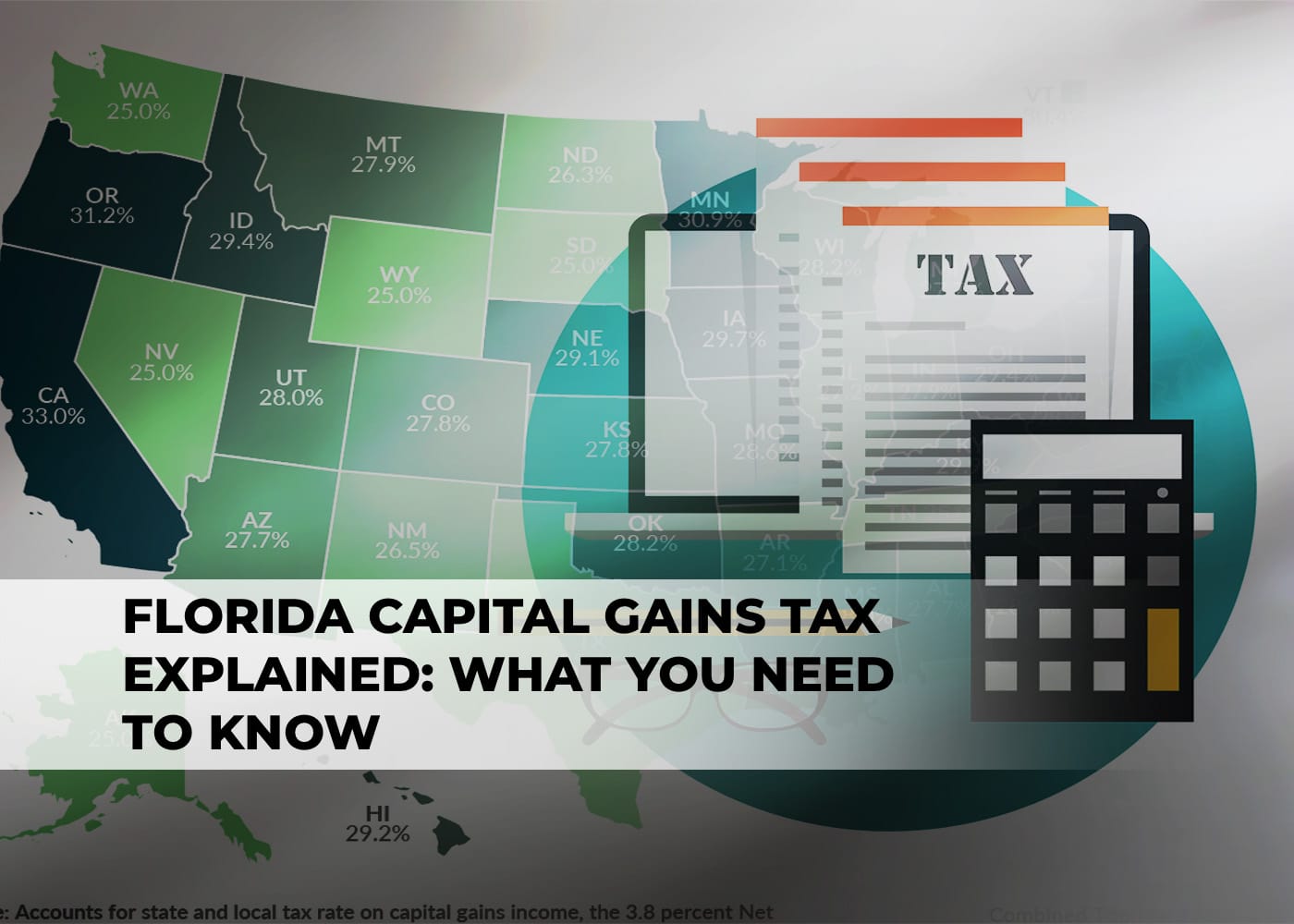

What About Florida State Taxes?

Here’s some good news for Sunshine State investors: Florida has no state income tax. That means no additional capital gains tax at the state level—something investors in New York or California can only dream of.

Still, your federal tax liability can be significant, especially if you’re not planning ahead. That’s where working with a fiduciary like myself can truly pay off.

Final Thoughts from David Kassir

Capital gains tax is one of those things most people don’t think about until it’s too late. But it doesn’t have to be that way. With the right plan, you can minimize taxes, protect your returns, and grow your wealth more efficiently.

At Manna Wealth Management, our job is to help you see the full picture. That includes taxes, investment risk, income planning, and legacy goals. And as a fiduciary advisor, I’m always focused on what’s best for you—not what earns us the most commission.

If you live in Florida and you’re wondering how capital gains will impact your investments, let’s have that conversation today.

Want to protect more of your gains?

Schedule a call with our Florida-based team at Manna Wealth Management, and let’s build a plan that works for you—not just the IRS.