With the increasing use of blockchain in different industries, the scalability issue has become paramount in its sustainability. Regardless of your familiarity with the blockchain space, you probably heard the terms ‘layer 1 or layer 2’.

Blockchain scalability: Why is it important?

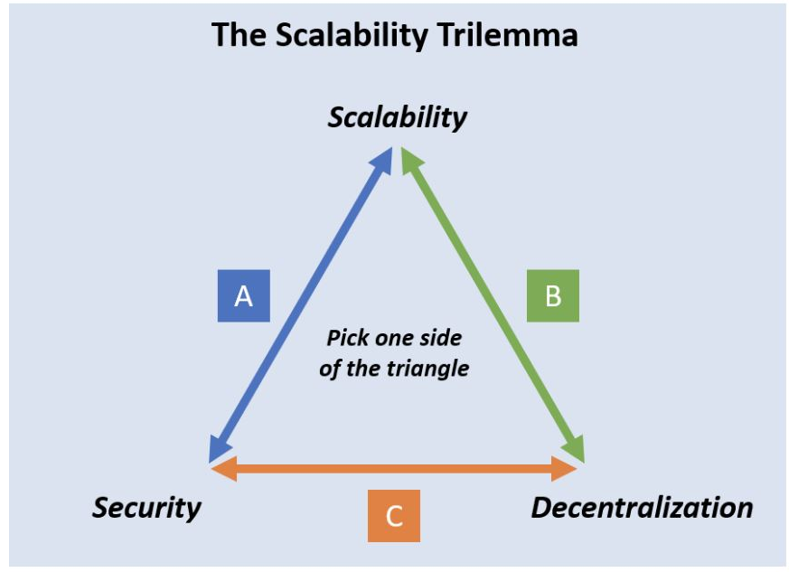

Simply put, blockchain scalability is the capability of the platform to support the number of nodes and transaction loads in the network. Blockchain has proven itself as the new pillar of the ‘Crypto network’. However, the basic structure of a decentralized network is still facing a major challenge—a good balance between security, decentralization and scalability. Source

Sometimes blockchain transactions consume a lot of processing power as well as time. If for any reason the network gets stuck with multiple transaction requests it will create an inequality in user experience. Now you can see the importance of scalability in the blockchain standard and how it plays a pivotal role in the future growth of blockchain. If there remains a lack of scalability the blockchain network may face performance degradation.

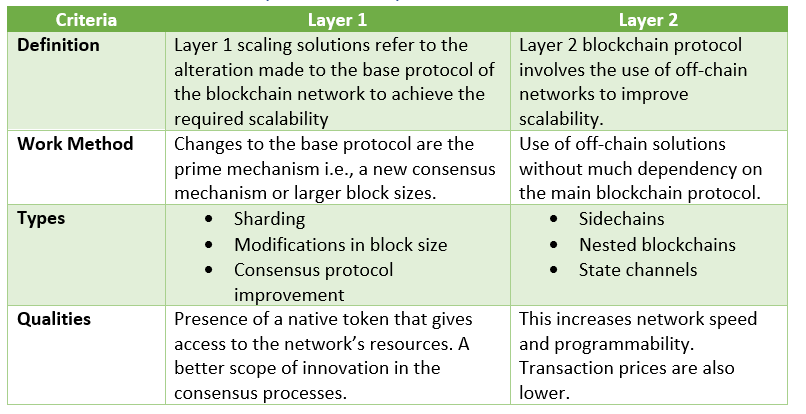

What is Layer-1 Protocol?

The layer 1 blockchain (Bitcoin, Ethereum, etc.) refers to the core protocol of the blockchain. It is also referred to as on-chain networking. Blockchain networks with layer 1 protocol come with their own crypto coins that compensate for transaction fees. The protocol can also validate, verify and finalize trades independently. –

There are a couple of effective methods for increasing the scalability with layer 1 solutions.

- Layer 1 enables direct modifications in protocol principles to potentially improve the capacity and speed of transactions.

- Layer 1 scaling provides a potentially better option for accommodating more users and data by improving the size of the block or speed of block creation.

How does Layer 1 work?

The project development team usually introduces layer-1 networks. There is a need for either a network hard fork or a soft fork by the community. The need is determined by the scaling solution coupled with some minor compatible changes. SegWit update on the Bitcoin network is an example of a change. Bigger changes like increasing the block size require a hard fork. The hard fork itself created 02 variations of the blockchain—one with the update & another without the update. Network size can also be increased by sharding which basically means creating smaller parts of the blockchain that can process data simultaneously to run the operation of the network. –

What is Layer-2 Protocol?

The blockchain space comes with opportunities that may lead to enhanced development. This idea is basically the driving force behind creating this alternative protocol. Layer 2 blockchain protocols run on top of an underlying blockchain ecosystem—hence termed as secondary frameworks. The primary purpose of this off-chain architecture is to potentially increase the transaction speed and minimize complexities. Layer 2 solutions transfer the transactional burden to the off-chain side that would report to the base blockchain network when the transaction is complete. This mechanism reduces the request congestion on the base blockchain network thereby boosting scalability. The Lightening Network that serves as a scaling solution for Bitcoin is a common example of a layer-2 scaling solution. Some other examples include sidechains, nested blockchains and state channels.

How does Layer 2 work?

Three methods have been utilized in layer 2 as enumerated below:

Rollup

The most common type is zero-knowledge rollups that use Proof of Validity to check the transaction integrity. This system combines layer 2 off-chain transactions and sends them to the main chain in real-time. All assets are stored in the main chain and bridged by smart contracts.

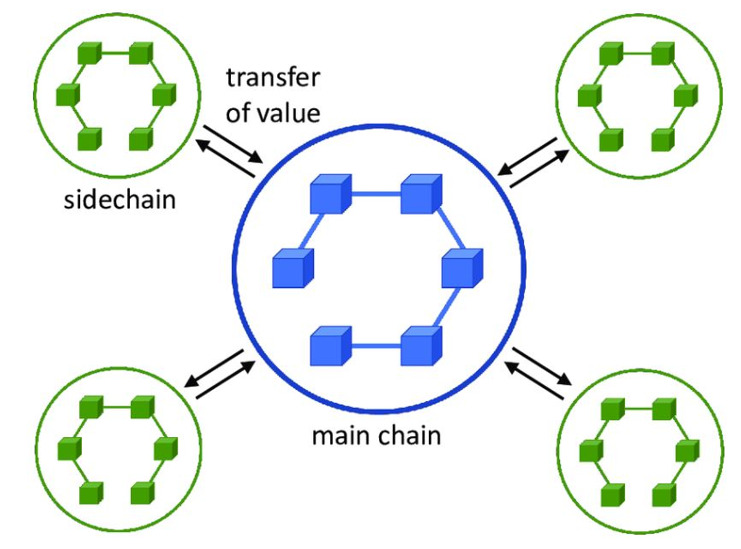

Sidechain

Sidechains are independent blockchain networks. The smooth operation of the sidechain on a continuous basis is vital as smart contracts verify the validity of the sidechain network. The sidechain also controls the assets on the main chain. Source

State Channel

Through a multi-signature smart contract, state channel maintains a 2-way communication between the transacting parties. Transactions are then executed without sending the data to the main chain.

Distinctions between Layer 1 and Layer 2 Blockchain

The cost difference between 2-layers of blockchains

Layer 2 blockchains are generally considered more cost-effective compared to its counterpart. Let’s take an example. The average cost of Ethereum layer 1 blockchain mining (including transfer) ranges between $50-$125. Whereas Polygon layer 2 transaction costs only around $0.05—significantly lower than layer 1. Source

Layer 1 and Layer 2—What lies ahead?

The scalability issue maybe blocking the mass adoption of crypto in the present day. With the increasing interest in cryptocurrency, pressure to scale blockchain protocols will also increase. Hence, the scalability trilemma may be solved by developing a protocol that can potentially overcome all of these constraints efficiently.

To Sum Up

With regard to the scalability bottleneck, it is evident that layer 1 & layer 2 blockchain protocols focus on attempting to improve scalability by using different methods. Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs) are attracting more users every day which in turn expanding the blockchain space. Consequently, scaling maybe necessary to potentially ensure the long-term sustainability of blockchains.

Many blockchain networks are already exploring the idea to combine layer 1 and layer 2 scaling solutions on the same blockchain network. The goal is to enhance scalability without compromising decentralization and security. Get to Know the Future, Get to Know Manna Wealth Management

FAQ About Blockchains

Blockchain: a system in which a record of transactions made in bitcoin or another cryptocurrency are maintained across several computers that are linked in a peer-to-peer network.

Scalability: Scalability of blockchain networks is the ability of that platform to support increasing load of transactions, as well as increasing the number of nodes in the network.

Nodes: In the context of crypto and blockchain, a node is one of the computers that run the blockchain’s software to validate and store the complete history of transactions on the network.

Transaction loads: Excessive number of transactions in a blockchain network.

Layer 1 protocol: A layer one protocol, which is sometimes called an implementation layer, refers to a system associated with the base or main architecture of a blockchain network.

Hard fork: A hard fork, as it relates to blockchain technology, is a radical change to a network’s protocol that makes previously invalid blocks and transactions valid, or vice-versa.

Soft fork: In blockchain technology, a soft fork is a change to the software protocol where only previously valid transaction blocks are made invalid.

SegWit: Segregated Witness (SegWit) refers to a change in the transaction format of Bitcoin.

Sharding: Sharding splits a blockchain company’s entire network into smaller partitions, known as “shards.” Each shard is comprised of its own data, making it distinctive and independent when compared to other shards.

Scaling: Scaling problems are an issue when the amount of data passing through the blockchain hits a limitation due to the insufficient capacities of the blockchain.

Sidechains: A sidechain is a separate blockchain that runs independent of Ethereum and is connected to Ethereum Mainnet by a two-way bridge.

Nested blockchain: A nested blockchain is essentially a blockchain within — or, rather, atop — another blockchain.

State Channels: State channels allow participants to securely transact off-chain while keeping interaction with Ethereum Mainnet at a minimum.

Disclaimer: The information and opinions expressed herein have been obtained from sources believed to be reliable but are not guaranteed for accuracy or completeness; are for information/educational purposes only; do not constitute a solicitation or recommendation for the purchase or sale of any security; are not unbiased/impartial; subject to change; may be from third parties. Opinions expressed are those of the Author and do not necessarily reflect those of B. Riley Wealth Management or its affiliates. Investment factors are not fully addressed herein. For important disclosure information, please visit www.brileywealth.com/legal-disclosures.

Recent Comments