Press

Retirement Planning in Malibu, CA

Retirement planning in Malibu is rarely about reaching a finish line. For most people I work with here, it’s about maintaining balance — financial, emotional, and personal — after decades of building something meaningful. Living in Malibu...

Fiduciary Financial Advisor in Malibu

Malibu is a unique place to live and work. People come here for the ocean, the privacy, and a certain sense of balance that is hard to find elsewhere. Financial planning in Malibu reflects that same mindset. It is not about excess. It is...

Financial Planning Services in Tampa, FL

Financial planning is not about predicting markets or chasing performance. It is about helping people make informed financial decisions over time, with a clear understanding of risk, goals, and changing life circumstances. In Tampa,...

Retirement Planning in Jacksonville, FL

Retirement planning is not about reaching a single number. It is about preparing for a phase of life that can last decades and adjusting along the way as circumstances change. In Jacksonville, Florida, retirement looks different for...

Fiduciary Financial Advisor in Orlando, Florida

Choosing a financial professional is one of the most important long-term decisions an individual or family can make. Whether planning for retirement, managing accumulated wealth, navigating business liquidity events, or preparing for...

Wealth Management for Entrepreneurs in Miami

As a financial advisor working with business owners and founders, I understand that entrepreneurs in Miami face a very different financial landscape than salaried professionals. Income volatility, liquidity events, reinvestment decisions,...

Financial Planning for Doctors in Miami

As a financial advisor working closely with medical professionals, I understand that physicians in Miami face a unique combination of opportunity and complexity. High earning potential, significant student loan burdens, evolving tax...

Retirement Planning for Federal Employees in Miami

As a financial advisor working with professionals across South Florida, I often speak with federal employees who want clarity around their retirement options. Federal benefits can be powerful—but they are also complex. Coordinating...

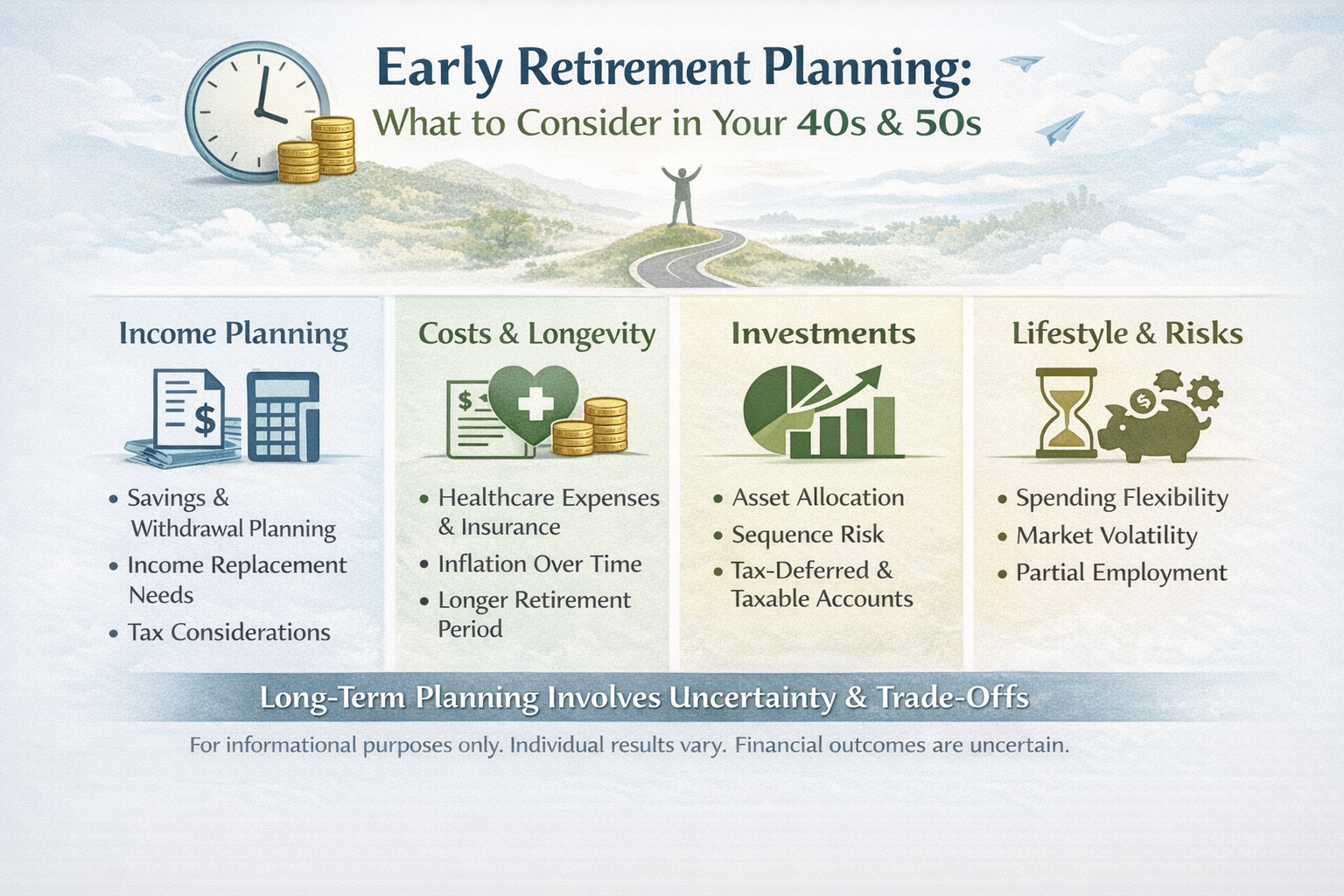

Early Retirement Planning: What to Consider in Your 40s and 50s

Introduction “Early retirement” is generally used to describe leaving full-time work before the traditional retirement age, often before one becomes eligible for standard government retirement benefits. For many individuals, serious...

Family Office vs. Traditional Wealth Management: Understanding Structural Differences

Different wealth management structures are designed to address varying levels of financial complexity and personal circumstances. Among the most commonly discussed models are family offices and traditional wealth management firms. While...

Cryptocurrency Tax Planning for Florida Investors in 2026

Cryptocurrency taxation continues to evolve as digital assets become more widely used for investment, transactions, and payments. While virtual currencies operate on decentralized networks, tax reporting obligations are generally...

How to Choose the Right Financial Advisor in California

Choosing a financial advisor is one of the most meaningful financial decisions you will ever make. This is not just about picking investments or chasing returns—it is about choosing a professional who understands your life, your goals,...

The 50/30/20 Rule vs. the Lifestyle Cap: Which Strategy Fits You?

When it comes to managing money, budgeting is often the first place people get stuck. Not because they don’t care—but because many budgeting systems feel unrealistic, restrictive, or disconnected from real life. Two popular approaches...

What Is a Bond, in Simple Terms?

A bond is a debt obligation. When an investor buys a bond, they are lending money to the issuer for a defined period. In most cases, the issuer agrees to: Pay interest at a stated rate (unless it is a zero-coupon bond) Repay the original...

What Is a Dividend?

A dividend is a payment that a company may choose to distribute to its shareholders, usually from its profits or retained earnings. Key points to understand: Dividends are not required by law Companies decide if, when, and how much to pay...

What Is an IRA Rollover?

An IRA rollover is a process that allows an individual to move retirement assets from one qualified retirement account into an Individual Retirement Account (IRA), or from one IRA to another, under specific rules. Rollovers are commonly...

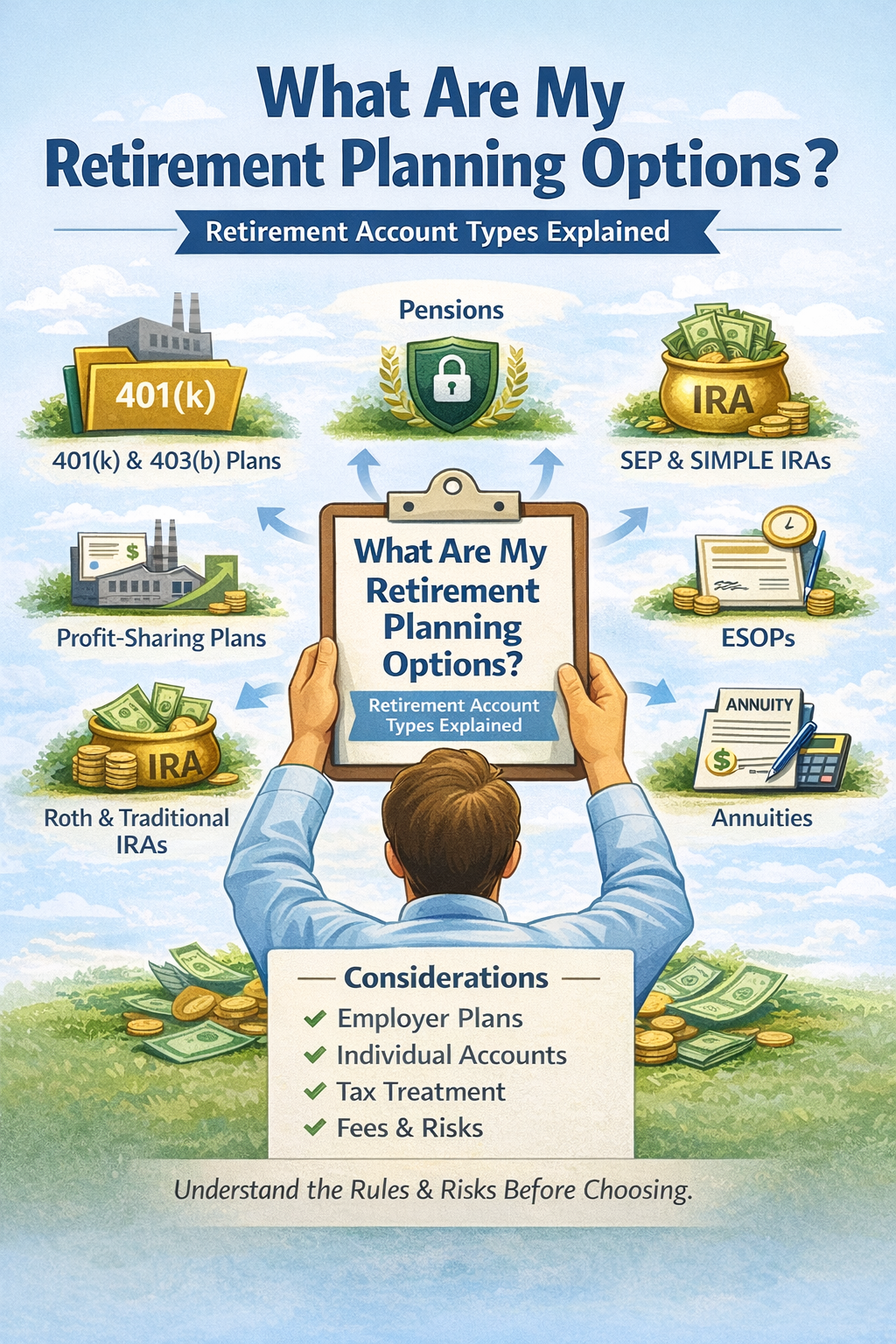

What Are My Retirement Planning Options?

What Are My Retirement Planning Options? Retirement planning involves selecting from a range of account types and benefit arrangements that help individuals set aside money for later life. Some options are sponsored and funded by...

Why Malibu Retirement Needs Thoughtful Planning

If you dream of living out your retirement years along the Pacific — with ocean breezes, warm sunsets, seaside strolls — then Malibu, California, might be calling your name. But life there, especially for retirees, carries a cost that’s...

Why Tax-Smart Investing Matters Especially in Malibu

When you live or invest in a high-income, high-cost area like Malibu, California, every dollar you keep after taxes makes a real difference. Tax-smart investing is not about predicting markets or promising results. It is simply about...

Why an Emergency Fund Matters — Especially in a Place Like Malibu CA

Malibu isn’t a typical small town. It’s coastal, picturesque, and yes — expensive. The cost of housing, groceries, healthcare, everyday services — all tend to run higher than in many other parts of the country. That already makes everyday...

Estate Planning 101 for Malibu Retirees

Estate planning is one of the most powerful tools Malibu retirees can use to protect their financial legacy, support their loved ones, and ensure their wishes are respected. In a place like Malibu—where real estate values can rise or fall...

How to Build a Malibu-Level Retirement Budget Without Stress

There’s something special about the word Malibu. It evokes sunshine, open vistas, ocean breezes, and a lifestyle that feels both calm and elevated. When clients come to me asking how to achieve a “Malibu-level” retirement, they’re not...

Avoid These Common Retirement Planning Mistakes Malibu Residents Make

Planning for retirement in Malibu comes with its own unique rhythm. Yes, the ocean views, relaxed mornings, and salt-air breezes set the stage for a picturesque chapter of life — but behind that serenity is a reality: Malibu is an...

Choosing the Right Financial Advisor in Malibu: What Retirees Should Look For

Retiring in Malibu isn’t just about stepping into a new phase of life — it’s about protecting a lifestyle you’ve worked decades to build. Whether you’re overlooking the Pacific from Point Dume, living in a quiet canyon home in Serra...

How Can a Malibu Financial Advisor Help Protect Your Coastal Property Wealth?

Living in Malibu comes with sunshine, ocean views, and a lifestyle many people dream about. But behind the sunsets and ocean breeze are real financial responsibilities. High-value coastal homes aren’t just expensive to buy — they’re...

What retirement options work best for people living in Malibu?

Retirement planning in Malibu looks a little different than it does in most places. The cost of living is higher, real estate is more valuable, and lifestyle expectations tend to be elevated. That means you need strategies that can...

How Malibu Retirees Can Protect Their Savings From Inflation

Retirement in Malibu sounds perfect, doesn’t it? Waking up to the sound of the ocean, grabbing coffee on the patio, taking a walk along the beach — it’s a lifestyle many people dream about. But there’s something a lot of retirees here...

Why High-Net-Worth Individuals in Malibu Need Personalized Wealth Management

Malibu is known for its beauty and lifestyle. The ocean, the hills, the homes—it’s a place that attracts wealth. But with wealth comes complexity. High-net-worth individuals here face financial challenges that are not simple. I’ve worked...

Top Investment Strategies for Malibu Residents in 2025 and Beyond

Malibu is one of the most unique places to live in the world. From Carbon Beach to Point Dume, from the estates along Pacific Coast Highway to the quiet hillside homes in Malibu Canyon, wealth here is tied to a lifestyle unlike anywhere...

Why Malibu Couples Should Revisit Their Retirement Plan Every 5 Years

Malibu couples often spend years building their careers, raising families, and enjoying the lifestyle this coastal community is known for. The ocean views, the high-end real estate, and the unique culture make Malibu a special place to...

The Future of Wealth Management in Malibu, California: Trends to Watch in 2026

Malibu, California, is unlike any other community. From the oceanfront estates along Pacific Coast Highway to the hillside homes above Zuma Beach, this coastal city combines luxury, lifestyle, and complexity. For residents here, wealth...

Retirement Planning in Los Angeles: How Much You Really Need

Retirement is not just about saving money. It’s about knowing how much you will need to live comfortably. Living in Los Angeles makes this even more important. Housing, healthcare, and everyday expenses are higher than the national...

How to Balance Real Estate and Stock Investments in California

How to Balance Real Estate and Stock Investments in California Investing in California is both exciting and challenging. The state offers unique opportunities in real estate and the stock market, but each comes with risks and costs....

The Future of Real Estate Investments in Malibu: Should You Buy, Sell, or Hold?

Malibu has always been more than just a place to live—it’s a global symbol of luxury, exclusivity, and lifestyle. For decades, owning property in Malibu has been seen as both a financial investment and a personal statement. But with...

Tax-Smart Investing for California Residents

California is known for sunshine, opportunity, and innovation—but it’s also known for having some of the highest taxes in the nation. For investors, that means paying attention not only to how much you earn, but also to how much you keep...

How Malibu Residents Can Maximize Social Security Benefits

For many Malibu residents, Social Security is just one piece of the retirement puzzle. While it may not cover the cost of a Malibu lifestyle on its own, maximizing Social Security benefits can provide a valuable source of reliable income....

Trusts vs. Wills: What Works Best for Malibu Families

For many Malibu families, building wealth is only part of the story. The other part is protecting it and making sure it’s passed on smoothly to the next generation. That’s where estate planning comes in. Two of the most common...

Financial Planning for Malibu’s Creative Professionals: Actors, Artists, and Influencers

Living and working in Malibu offers a unique lifestyle—one filled with creativity, opportunity, and at times, unpredictability. Whether you are an actor landing roles in Hollywood, an artist showcasing your work, or a social media...

How Much Can I Safely Withdraw Each Year Without Running Out of Money?

When people come into my office here at Manna Wealth Management, one of the first questions they ask me is: “David, how much can I safely take out of my retirement accounts each year without running out of money?” It’s a fair question....

What Happens If I Retire During a Market Downturn?

This is a question I get all the time at Manna Wealth Management: “David, what happens if I retire right when the stock market is down?” It’s a valid concern. Nobody wants to start retirement just as the market takes a dive. After all,...

Should I Convert My IRA to a Roth?

When I meet with families at Manna Wealth Management, this question comes up a lot: “David, should I convert my IRA to a Roth?” It’s a fair question, and the truth is—there’s no one-size-fits-all answer. Sometimes it makes a lot of sense....

How Weather and Natural Disasters Impact Your Financial Plan in Florida

Living in Florida has many advantages — year-round sunshine, no state income tax, and a lifestyle that’s hard to beat. But as beautiful as our state is, it’s no secret that we’re also prone to hurricanes, flooding, and other natural...

Navigating Divorce and Finances: What Women Need to Know

Divorce is more than a legal process — it’s a life-altering financial event. As a wealth manager who has guided clients through countless transitions, I’ve seen how divorce impacts women uniquely — emotionally, legally, and especially...

Estate Planning Checklist: What You Need Before You Turn 60

Turning 60 is a major milestone — and one that comes with both freedom and responsibility. If you’re like many of the clients I work with at Manna Wealth Management, you’ve spent a lifetime building your wealth, raising a family, and...

Wealth Management for Beginners: Where to Start

When I meet with someone new to wealth management, I often hear the same question: “Where do I even start?” It’s a fair question—and one I’ve answered many times over the years. Whether you’re in your early 20s just entering the workforce...

The Best Retirement Accounts for Building Long-Term Wealth

When it comes to retirement, the single most powerful factor is time. The earlier you start planning and investing, the better positioned you’ll be to live comfortably—and confidently—in the future. But knowing how and where to invest...

Active vs. Passive Investing: Which Is Right for You?

One of the most frequent questions I get from clients—whether they're in Miami, Orlando, or Naples—is this: "Should I be actively managing my investments, or is it better to take a passive approach?" The answer, like many things in wealth...

Why So Many Retirees Choose Florida — and How to Plan for It

For decades, Florida has been a magnet for retirees. As someone who’s advised individuals and families for over 20 years—many of whom made the move to the Sunshine State—I can tell you that Florida offers far more than just palm trees and...

What Is the Power of Compounding and Why It Is Such an Important Concept?

When it comes to building lasting wealth, there’s one concept that I believe stands above the rest in its ability to quietly but profoundly change lives: the power of compounding. Over my 28 years in private wealth management, I’ve worked...

Why Tax Planning Should Be Part of Your Wealth Strategy

When most people think about building wealth, they immediately picture investment portfolios, real estate assets, retirement accounts, or even business ventures. Over my 28+ years in private wealth management, I’ve seen time and again...

How to Teach Kids About Saving and Investing

I’ve worked with multiple generations of families, helping them secure their financial futures. One of the most rewarding aspects of my work is watching parents not only build wealth—but also pass down financial wisdom to their children....

Gifting Wealth While You’re Alive: Pros and Cons

When people think about passing on wealth, they often imagine it happening after they're gone. Whether you live in Boca Raton, Tampa, or anywhere along Florida’s beautiful coast, chances are you’ve worked hard to build your wealth. And if...

Bonds vs. Stocks: Which Should You Prioritize in Today’s Market?

If you’re an investor in Florida wondering where to put your money right now—stocks or bonds—you’re not alone. I’ve had this conversation with countless clients from Naples to Jacksonville, especially in today’s uncertain economy. Rising...

Retirement Planning Tips for Business Owners

As a business owner in Florida, you’ve probably spent most of your adult life building something meaningful—whether it’s a law firm in Miami, a boutique in Sarasota, or a construction company in Jacksonville. You’ve taken the risk, made...

Lost a Job? Here’s What to Do With Your Old 401(k) or Thrift Savings Plan

What to Do with an Old 401(k) or TSP After Job Loss Losing a job can feel like the rug’s been pulled out from under you—but your long-term financial security doesn’t have to go with it. If you’ve recently been laid off or left your...

Top Financial Mistakes to Avoid in Your 40s, 50s, and 60s

At Manna Wealth Management, we’ve spent decades guiding clients through every stage of life. One of the most common patterns we see? Costly financial missteps that could have been avoided with a little foresight and expert guidance....

Top Financial Planning Mistakes to Avoid in Your 40s and 50s

our 40s and 50s are often your peak earning years—and also a critical time to make sure your financial plan is working for you, not against you. With retirement looming closer and life expenses still running high, it's easy to make...

Understanding Backdoor Roth IRAs and Mega Backdoor Roths: A Guide for High-Income Earners

Understanding Backdoor Roth IRAs and Mega Backdoor Roths If you're a high-income earner looking to maximize your retirement savings and reduce long-term tax exposure, you've likely run into income limits that restrict contributions to a...

How to Choose the Right Financial Advisor for Your Needs

When it comes to securing your financial future, one of the most impactful decisions you can make is choosing the right financial advisor. Whether you're planning for retirement, building generational wealth, or simply trying to get a...

Tips for Finding the Best Financial Advisors in Northern Virginia

Choosing the right financial advisor can be one of the most important decisions you make when it comes to your financial future. Whether you're planning for retirement, saving for college, or looking to build long-term wealth, having a...

Why You Need a Financial Plan (Even If You Think You Don’t)

If you’re like many people I’ve worked with, the idea of creating a formal financial plan might seem unnecessary—especially if you’re earning well, paying your bills, and saving a little each month. But here's the truth: even if your...

The Truth About Social Security in Florida: What You Should Know Before You File

Planning for retirement involves many important decisions, but perhaps none are as crucial—or as misunderstood—as the decision of when and how to file for Social Security benefits. If you live in Florida and are approaching retirement...

From Golf to Gulf: How Florida Offers Endless Activities for Retirees

Retirement is no longer a time to slow down — it's a chance to truly live. And for those who want to stay active, social, and engaged well into their golden years, Florida is unmatched in both opportunity and lifestyle. From world-class...

The Ultimate Guide to a Backdoor Roth IRA

If you're a high-income earner looking to maximize your retirement savings, you've likely heard of the Backdoor Roth IRA. It’s a strategic tax-advantage maneuver that allows individuals to bypass income limits imposed on direct Roth IRA...

Why Retiring in Florida is a Dream Come True

Retirement marks the start of an exciting new chapter, and for many, Florida is the perfect backdrop to write this next phase of life. With its sunny weather, endless recreational opportunities, and vibrant communities, it’s no wonder the...

Why Aren’t More Small Business Owners Putting Their Kids on Payroll?

If you’re a small business owner with kids, you’ve got an untapped opportunity to elevate both your business and your children’s future. By legally hiring your kids to work for your business, you can reduce your taxable income while...

How Are Short-Term Rentals Taxed? Everything Hosts Need to Know

The Basics of Short-Term Rental Taxation As short-term rental properties grow in popularity among real estate investors, so do the questions surrounding how they are taxed and structured. These properties receive unique tax treatment from...

The Top Financial Mistakes Couples Make—and How to Fix Them

How to Master Money Together Without the Stress or Fights Whether you’re dating seriously, newly married, or decades into your partnership, financial stress is one of the top causes of relationship tension and divorce. But here’s the good...

What Happens to Your 401(k) When You Switch Jobs?

Your Step-by-Step Guide to Rollover Options and Tax Consequences Switching jobs can be both exciting and nerve-wracking—new opportunities, new challenges, but also a lot of logistical changes. One thing that often gets overlooked in the...

How to Prepare Financially for a Recession in 2025

Strategies to Weather the Storm and Protect Your Wealth A recession can feel like a storm on the horizon—uncertainty, job losses, and market volatility all swirling in a way that can make anyone feel anxious. The good news? Preparation is...

How to Build Wealth in Your 30s Without Taking Big Risks

Simple Investment & Savings Habits That Actually Work If you're in your 30s, this is one of the most important decades of your financial life. You’ve likely started making a steady income, you may have some debt to manage, and you're...

How Much Life Insurance Do You Really Need?

Smart Ways to Calculate What’s Right for Your Family and Lifestyle Life insurance is one of those things that people often don’t think about—until it’s too late. But if you’ve ever asked yourself, “How much life insurance do I actually...

Cryptocurrency and Taxes: What Florida Investors Should Know in 2025

Understand the Rules, Avoid IRS Mistakes, and Maximize Your After-Tax Gains If you're a Florida resident diving into the world of cryptocurrency—whether you're buying Bitcoin, trading altcoins, or earning yield through DeFi—you need to...

Considering Bitcoin for your retirement savings?

The Bitcoin Buzz: Is it a Suitable Option for Your Retirement Savings? Unravel the benefits and drawbacks of incorporating crypto into your 401(k) Have you heard that Bitcoin might soon be an investment option in some 401(k) plans?...

Get ready for Bitcoin Halving 2024! 🎢 Time to buckle up?

Thrilling news on the horizon! The much-anticipated Bitcoin Halving is due in April 2024! This mega event is set to capture the focus of not just us, the crypto buffs, but also the traditional investors who have their eyes set on the...

How Long Will My Retirement Savings Last in Florida?

Retirement is a time to enjoy the fruits of your hard work and spend more time with your loved ones. But it also comes with some financial challenges. How do you make sure that your retirement savings will last as long as you need them?...

Ready to invest in Bitcoin Hassle-Free?

Have you ever been captivated by the allure of investing in Bitcoin, yet found yourself held back by the perceived intricacies or potential risks involved? It's comparable to having a craving for a slice of warm, homemade apple pie, but...

Bitcoin and Taxes: What You Need to Know About Cryptocurrency Regulations in Florida

In the sunshine state, where oranges grow and beaches stretch for miles, a new player has entered the financial scene - Bitcoin. As a Florida resident navigating the crypto landscape, understanding the tax implications of your Bitcoin...

Real Estate and Crypto: An Intriguing Combination for Florida Investors

Florida, known for its sunshine, beaches, and vibrant real estate market, is becoming a hotspot for a unique blend of traditional and innovative investments—real estate and cryptocurrency. In this article, we'll explore why this...

Green Investing: How Financial Advisors Drive Real Estate Choices

Green investing has evolved from being a niche concept to a mainstream financial strategy. As the world grapples with environmental challenges, the spotlight is now on sustainable real estate choices, and financial advisors play a pivotal...

What Exactly does a Financial Advisor do?

A Financial Advisor is a professional who provides guidance and advice on managing your finances. They typically assist in various areas of finance such as investments, retirement planning, tax strategies, insurance, and estate planning....

529 Plan: A Comprehensive Guide to Saving for Education

Saving for higher education can be a daunting task, but with the right financial planning, it is possible to make this goal more achievable. One popular method for saving for education is through a 529 plan. In this article, we...

Secure a Bright Future: How Saving Up for Education Planning May Change Your Life

In today's competitive world, a good education is essential for the success and future of our children. As parents, it is our responsibility to ensure that our children have access to quality education that can open doors to numerous...

David D. Kassir Selected as One of 200 Fast Growing Advisors to Watch

Press Release: MIAMI, FL | June 22, 2023 With double the number of nominees this year from over 374 firms vying for the title. The criteria for selection included a minimum of seven years experience, $100m minimum AUM, and a clean...

What are the Tax Advantages of a 401(k) or an IRA

Retirement savings are essential for securing financial stability in the golden years. Two popular retirement savings options in the United States are the 401(k) and the IRA (Individual Retirement Account). Both these plans offer...

How can I plan for Unexpected Medical Expenses

Medical emergencies can strike at any time, and the associated costs can be overwhelming. To protect yourself and your finances, it's crucial to plan for unexpected medical expenses. By taking proactive steps and making informed...

How Can I Plan for a Financially Secure Divorce?

Divorce is a challenging life event that can have significant financial implications. Planning for a financially secure divorce requires careful consideration of various factors to ensure your long-term stability. In this article, we will...

How Can I Plan for Early Retirement?

Understanding Early Retirement Planning for early retirement is a goal that many individuals aspire to achieve. The concept of leaving the workforce earlier than the traditional retirement age can be enticing, offering more freedom,...

David Kassir, CEO of Manna Wealth Management, Attends 2023 Bitcoin Conference in Miami Beach for Third Year In a Row

Miami Beach, FL - David Kassir CEO of Manna Wealth Management, attends the 2023 Bitcoin Conference in Miami Beach for the third year in a row. David sees the Bitcoin conference as a key opportunity to keep up-to-date with the newest...

Want to retire comfortably? Use the Rule of 70 to Estimate how long it will take you to reach your Financial Goals.

For anyone wondering how to best plan for retirement, the Rule of 70 can provide invaluable insight. The concept can help investors understand both the power of compound interest and how long it takes for investments to double. Whether...

What Happens to 401k when you Die?

How Does a 401k Work? A 401k is an employer-sponsored retirement plan that allows employees to save money for their future while deferring taxes on those funds until they are withdrawn in retirement. It also allows employers to...

A Few Things You Need to Know About Capital Gains Taxes in the United States

When it comes to taxation, the United States has a complex system with many different types of taxes. One type of tax that some people may not be familiar with is the capital gains tax. In short, capital gains taxes are levied on the...

IRA, Roth IRA, and 401k: Which is Right for you?

If you're like most people, the words "IRA," "Roth IRA," and "401k" probably make your eyes glaze over. Retirement account types can be confusing, and it's hard to know where to start. Savings accounts, checking accounts, money market...

6 Wealth Building Steps to start at any age in Life

People often associate wealth with having a lot of money. But wealth is not about having a large sum of money. It's about having enough money to do what you want. If you want to build wealth, it's important to start with the right...

Planning a Successful Retirement as a Government Employee

Whether you're a government employee who is nearing retirement or you're still several years away, it's never too early to start thinking about and planning for retirement. There are some key things that government employees need to keep...

Financial Planning in Virginia, What is it?

Financial planning plays a vital role in helping people determine if they will be able to meet their outlines and goals in their path to financial success. Many people today live complex financial lives and they often struggle to plan for...

What is DAO? The Jargon-Free Beginner’s Guide

Decentralized Autonomous Organization (DAO) is a community-led entity with no central authority. DAO is pronounced as “Dow” like “the Dow Jones.” Unlike the traditional organizations that are governed by a board or executive committees,...

What are GAS Fees anyway?

There's nothing more frustrating than losing money. But that's exactly what happens when you pay high fees for crypto transactions... or fees on transactions that fail. What is a gas fee anyway? Gas fee is the term given to transaction...

What’s the Difference Between LAYER 1 and LAYER 2 Blockchains

With the increasing use of blockchain in different industries, the scalability issue has become paramount in its sustainability. Regardless of your familiarity with the blockchain space, you probably heard the terms ‘layer 1 or layer 2’....

The Truth About Crypto Staking

What is crypto staking? Staking is seen as the crypto world’s equivalent of earning interest or dividends by holding onto crypto assets. For example, when you deposit a certain amount of money in a savings account, the bank utilizes the...

What Is The Metaverse? It’s Meaning And What You Should Know

The Metaverse is a term that has been extremely popular lately within the sphere of crypto. Especially with the rise in popularity of non-fungible tokens (NFTs), it seems that there has never been more interest within this virtual world...

What is an NFT? – A Beginner’s Guide

Global NFTs saw an increase in year-on-year sales in March 2022. The Q1 of this year experienced the total NFT market trading volume at about $12.13 billion. What Is a Non-Fungible Token (NFT)? NFT is an acronym that stands for...

Senior Financial Advisor and Bitcoin enthusiast , David Kassir attends Miami’s Annual Bitcoin 2022 Conference

May 4, 2022 – Miami, FL - Senior Financial Advisor and Bitcoin enthusiast, David Kassir of Manna Wealth Management attended Miami’s premier 2022 Bitcoin Conference. The four-day event brought together developers, business leaders,...

Finding the Right Financial Advisor

Let’s be honest: Making personal financial decisions can be challenging. There’s a variety of investment options, all of which carry some form of risk. And, of course, there are many types of retirement plans to choose from, each with...

Choosing a Wealth Management Firm in Virginia

1. Get a Feel for Their Ideal Client In general, wealth management firms cater to investors who have a sizable asset base, but they don’t all take the same approach. Some wealth managers may prefer to work with clients who have...

Miami Magazine – On The Clock feature Spotlights Miami Financial Advisor David D. Kassir

Miami, Washington DC Financial Advisor David D. Kassir Invited to CNBC Delivering Alpha Event

Manna Wealth Management’s Senior Financial Advisor, David D. Kassir invited to this year’s Delivering Alpha investor summit, September 19 at New York’s Pierre Hotel. About Delivering Alpha: Since 2010, CNBC has worked side by side...

Success by South Beach – Miami Financial Advisor David Kassir Featured to Speak

Senior Financial Advisor, David D. Kassir, with offices in Washington DC & Miami, FL was Featured to speak at Success by South Beach. This event was hosted at the SLS Hotel in Miami Beach, FL. on August 15 , 2019. The Event featured...

Financial Advisor David D. Kassir Attends 2019 Morningstar Investment Conference

David D. Kassir, Senior Financial Advisor & Managing Principal of Manna Wealth Management Attended the 2019 Morningstar #MICUS conference hosted at McCormick Place in Chicago, IL ( May 8, 2019). This year’s conference brings...

Financial Advisor David Kassir for 2019 Forbes Top Advisor Summit

Schedule an Initial Phone and See how we can help: Visit mannawealthmanagement.com or Call our Office at 703-533-0030 or Florida residents please call 305-306-7107. ...

Washington DC Financial Advisor – David D. Kassir invited to CNBC

Capital Exchange focuses on the confluence of policy, money and growth. Beyond the political posturing and partisan rancor, the policy decisions made in the corridors of the Capitol are informed by, and greatly affect, the boardrooms of...

Finding Right Financial Advisor in Crystal City, VA

When the news of Amazon broke out that it has chosen its second headquarters to be located in Crystal City, VA – Arlington, questions about population density, the potential for skyrocketing rents and rising costs in commerce immediately...

Financial Advisor David D. Kassir invited to CNBC Capital Exchange Summit hosted at the Intercontinential Hotel in Washington, DC

Capital Exchange focuses on the confluence of policy, money and growth. Beyond the political posturing and partisan rancor, the policy decisions made in the corridors of the Capitol are informed by, and greatly affect, the boardrooms of...

David D. Kassir, Financial Advisor, chosen to attend the Barron’s Regional Summit

DAVID KASSIR – Invited to be a part of the Barron’s Regional Summit Conference. Washington, DC (May 31, 2018)—Washington DC & Miami, FL . This private wealth summit serves as the basis for financial advisors to share their ideas in...

Financial Advisor David Kassir Featured in Forbes Magazine

We expect our financial advisors to have an in-depth understanding of financial markets and investment products, of retirement planning and college funding. David Kassir expects even more of himself. “A mentor once told me, a great...

Financial Advisor David Kassir featured in Miami Herald

WASHINGTON, Nov. 17, 2014 - PRNewswire. Senior Financial Advisor David D. Kassir, of Manna Wealth Management, hosted by Barron’s magazine to promote best practices in the industry and the value of advice to the investing public....

Start the Conversation